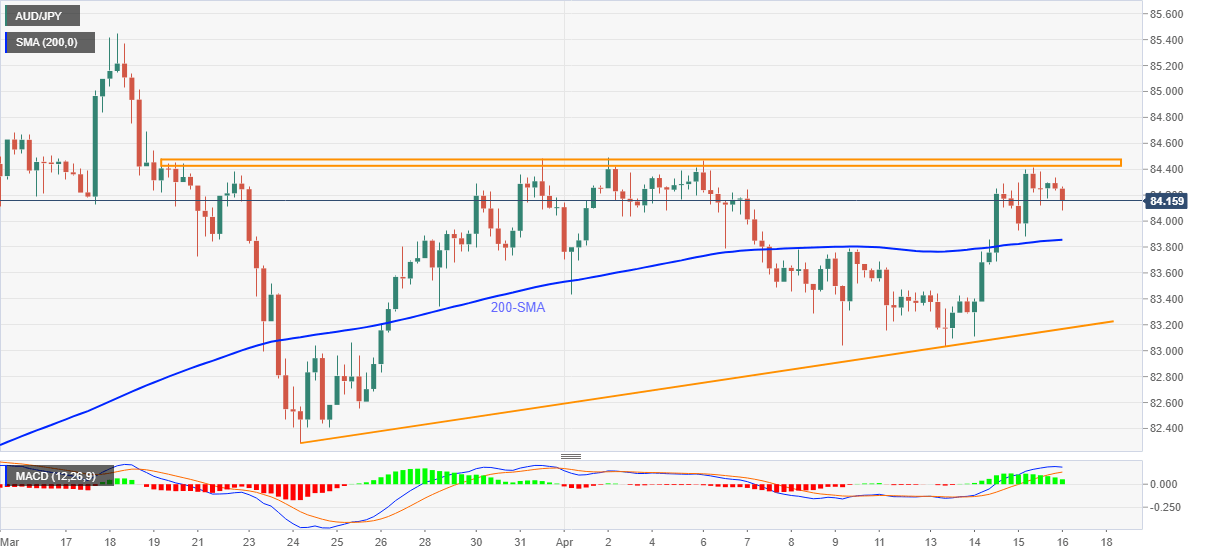

- AUD/JPY retreats from short-term ascending triangle resistance, refreshes intraday low on mixed China data.

- Receding bullish bias of MACD directs the quote towards 200-SMA.

- Bulls can eye March’s top beyond monthly horizontal resistance.

AUD/JPY takes offers around 84.10, down 0.25% intraday, after China flashed mixed data on early Friday. In doing so, the cross-currency pair steps back from the resistance line of a four-week-old ascending triangle formation.

Read: China’s GDP sees a record expansion of 18.3% YoY in Q4 2020 vs 18.9% expected, AUD/USD unfazed

Not only a lack of strong economics from Australia’s biggest customer but receding bullish bias of the MACD also favors AUD/JPY sellers targeting a 200-SMA level of 83.85. However, the 84.00 threshold offers immediate support to break.

In a case where the AUD/JPY prices drop below 200-SMA, the stated triangle’s support line near 83.15 will be the key to watch.

Meanwhile, an upside break of 84.50 should defy the bearish chart pattern and trigger a fresh rally targeting March’s top of 85.45.

During the rise, February’s top near 84.95 and the 85.00 round-figure may test the short-term AUD/JPY buyers.

AUD/JPY FOUR-HOUR CHART