- AUD/USD refreshes the post-Tokyo open high.

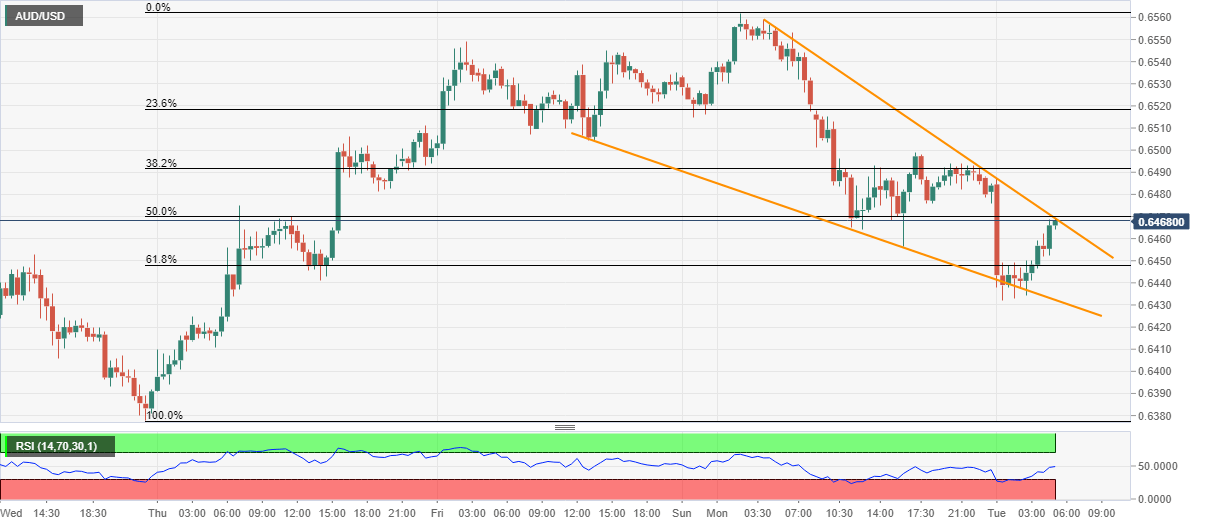

- A confluence of the two-day-old falling trend line, 50% Fibonacci retracement caps immediate upside.

- 0.6400 round-figure may offer additional downside filter.

AUD/USD takes the bids near 0.6470, still down 0.37 on a day, while heading into the European session on Tuesday.

In doing so, the Aussie pair extends pullback from short-term falling wedge bullish chart pattern while inching closer to the confirmation point that also includes 50% Fibonacci retracement of May 06-11 upside.

Hence, a clear break above 0.6470 will trigger fresh recovery moves of the pair targeting 0.6515 and the monthly top near 0.6565.

Alternatively, 61.8% Fibonacci retracement level and the bullish pattern’s support line, respectively near 0.6445 and 0.6430, keep the pair’s short-term declines limited.

In a case where the AUD/USD prices slip below 0.6430, their slump to Wednesday’s low near 0.6375 can’t be ruled out. Though, 0.6400 might offer intermediate support.

AUD/USD 30-minute chart

Trend: Further recovery expected