These are the main highlights of the CFTC Positioning Report for the week ended on February 16th:

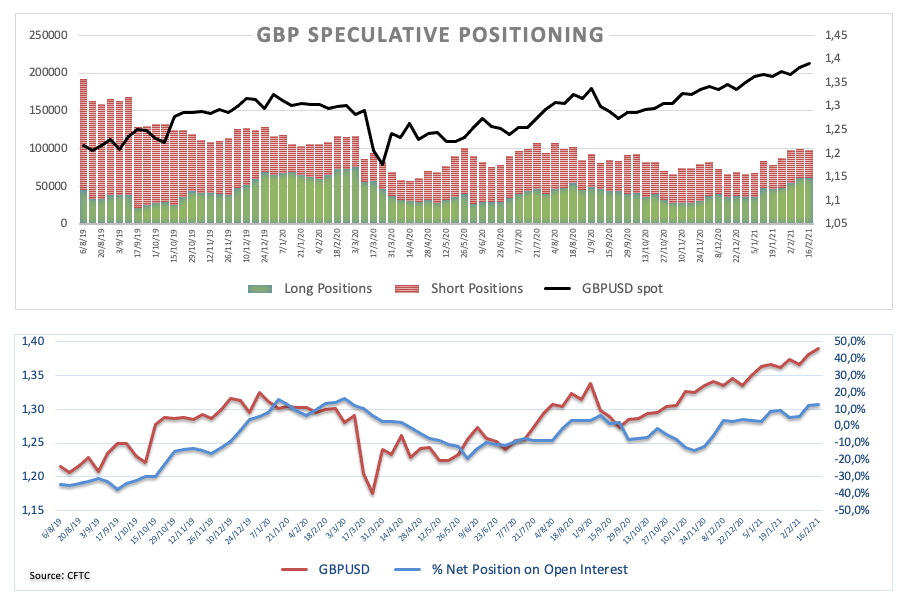

- Net longs in the British Pound rose for yet another week and increased to levels last seen in early March 2020. In fact, the positive momentum of the sterling remains underpinned by the shrinking probability that the BoE could cut rates into the negative territory in the near-term. Also supporting the quid appear the firm pace of the vaccine rollout in the UK plus encouraging results from the domestic docket.

- Speculators kept the positive view on the EUR well and sound, although net longs eased marginally to 2-week lows. The rangebound trading in spot follows dollar dynamics as well as the developments in the risk-associated universe, where the reflation trade and rising hopes of a strong recovery in the region in the second half of the year continue to dominate the sentiment.

- The speculative community trimmed its net shorts in the USD to 3-week lows on the back of the persistent rebound in US yields, as investors continue to adjust to the idea of a pick-up in US inflation in response to extra fiscal stimulus in the next months.

- Higher yields in the US bond markets impacted on the price of the ounce troy of Gold, prompting speculators to reduce their net longs to levels last seen back in September 2020.