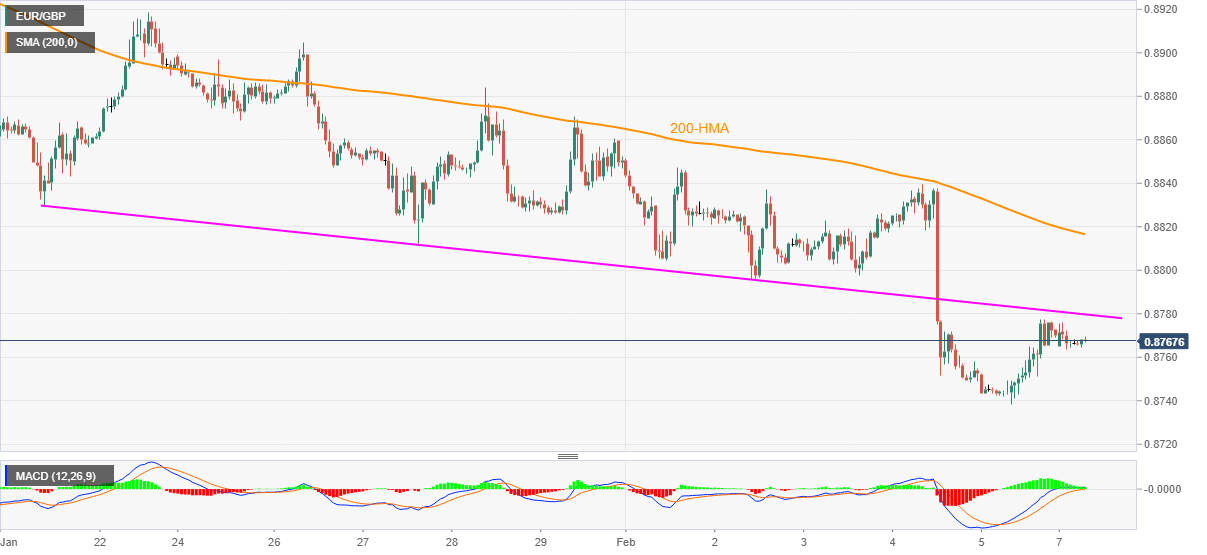

- EUR/GBP fades bounce off multi-month low marked on Friday.

- Receding strength of bullish MACD also conveys challenges to upside momentum.

- A falling trend line from January 21 tests the bulls targeting 200-HMA.

- Bears await clear break of the early March 2020 tops to add positions during further weakness.

EUR/GBP wavers around 0.8768 while fizzling the intraday bounce off 0.8763 during the pre-European session trading on Monday. In doing so, the pair also fails to extend Friday’s recovery moves from the lowest since May 2020.

While portraying the underlying weakness in the trading momentum, receding bullish MACD signals and inability to cross the two-week-old resistance line, previous support, around 0.8780, also challenge the EUR/GBP buyers.

It should, however, be noted that the pair’s sellers will have to drop below the early March 2020 top surrounding 0.8745 to retake the controls.

Following that, the 0.8700 round-figure and April 2020 bottom close to 0.8670 should gain the market attention.

Meanwhile, an upside clearance of 0.8780 can please intraday buyers with the 0.8800 round-figure but 200-HMA near 0.8815 will test the EUR/GBP bulls afterward.

EUR/GBP HOURLY CHART

Trend: Bearish