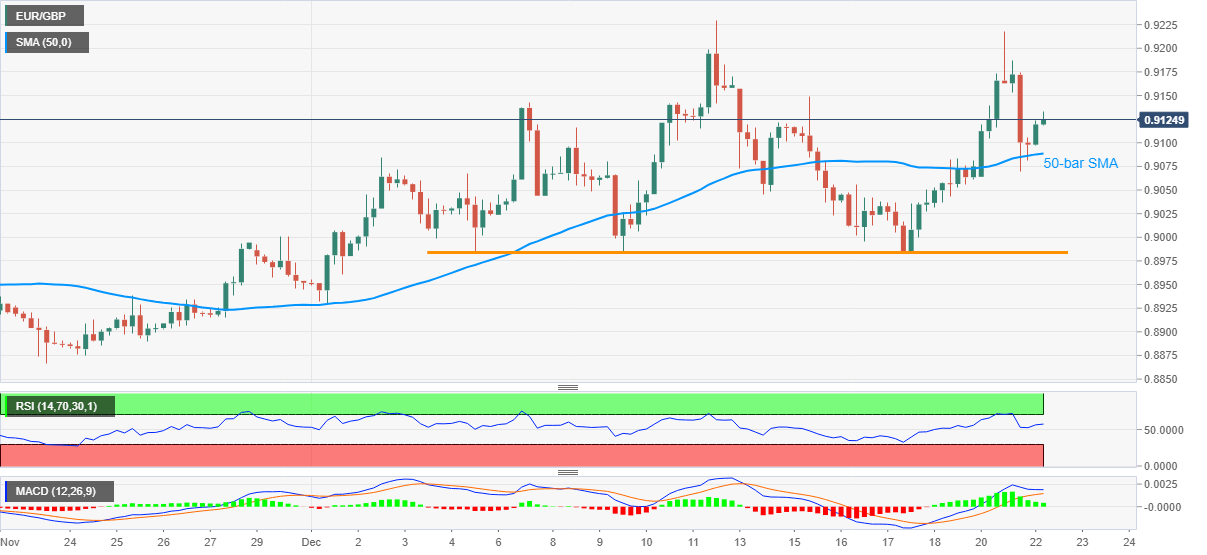

- EUR/GBP keeps recovery moves from 0.9069 amid bullish MACD, strong RSI.

- Sustained trading above 12-day-old horizontal support, 50-bar SMA favor buyers.

- Monthly top, yearly peak on the bulls’ radars.

EUR/GBP justifies the previous day’s bounce off 50-bar SMA while taking the bids near 0.9127, up 0.39% intraday, ahead of Tuesday’s London open.

In addition to the successful U-turn from the key SMA, the pairs’ ability to stay strong beyond the multiple lows marked since December 04, at 0.8983, also favors the EUR/GBP bulls. Furthermore, upbeat RSI conditions and bullish MACD add strength to the north-run.

That said, the quote currently eyes the monthly peak surrounding 0.9230, a break of which will accelerate the uptrend towards September’s high near 0.9291.

While the 0.9300 round-figure is expected to test the bulls past-0.9291, any further upside may not hesitate to challenge the year top close to the 0.9500 round-figure.

Alternatively, 50-bar SMA around 0.9085 offers immediate support to the pair ahead of the stated horizontal support near 0.8980.

If at all the EUR/GBP bears manage to break the 0.8980 level, the monthly bottom of 0.8929 and the late November lows near 0.8865 could return to the charts.

EUR/GBP FOUR-HOUR CHART

Trend: Further upside expected