- GBP/JPY picks up bids following its bounce off 144.44.

- Overbought RSI suggests further pullback amid failures to cross February 2020 top.

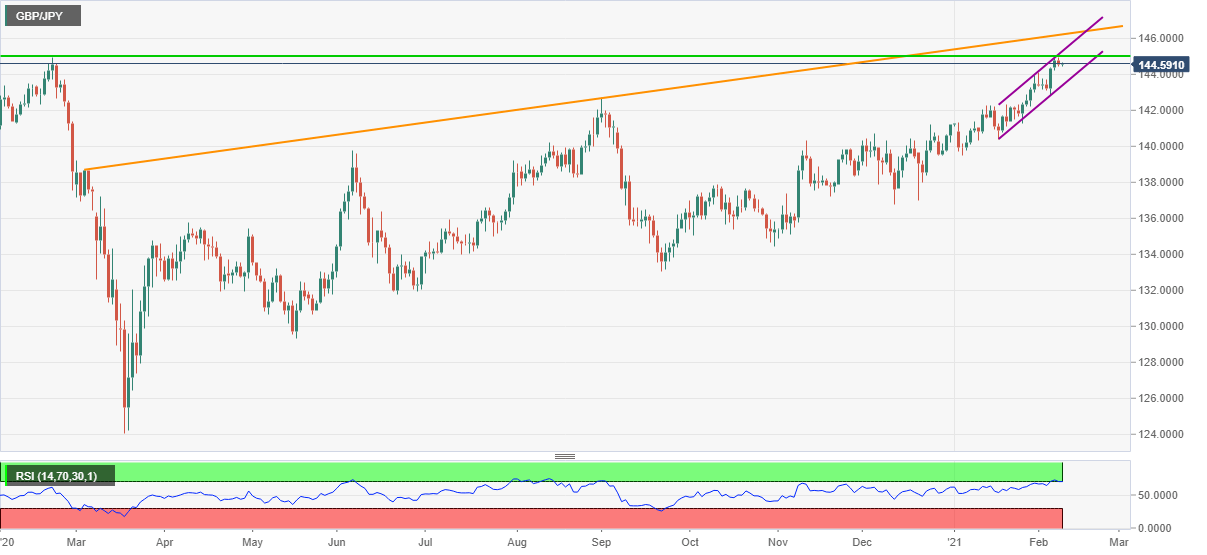

- Immediate channel’s resistance, ascending resistance line from March add to the upside filters.

GBP/JPY portrays recovery moves from the intraday low of 144.44 to currently around 144.58 ahead of Tuesday’s London open.

The quote jumped to the 12-month high the previous day but overbought RSI dragged it back from the yearly peak.

Considering the pair’s sustained trading below the key resistance around 145.00, coupled with the overbought RSI conditions, GBP/JPY is likely to witness further downside.

However, even the short-term sellers are less are likely to get serious until the quote remains inside a three-week-old rising channel, currently between 145.30 and 143.40.

Meanwhile, an upside clearance of 145.00, also the run-up beyond 145.30, will target an 11-month-old resistance line, at 146.20 now, during the further upside.

To sum up, GBP/JPY is expected to witness a pullback in the overall bullish trend.

GBP/JPY DAILY CHART