- GBP/USD takes the bids near intraday high as US dollar weakness joins hopes of easy budget for the UK.

- Brexit pessimism keeps dragging the bulls surrounding the short-term resistance line.

- Unlock optimism, vaccines news add to the propellant ahead of the US Q4 GDP.

GBP/USD stays on the front foot while refreshing the intraday high with 1.4164, up 0.18% on day, ahead of Thursday’s London open. In doing so, the quote rises for the sixth consecutive day despite the previous day’s pullback from a 34-month high.

Hopes of no major tax hikes and an easy flow of money, be it through fiscal policies, likely from the UK Chancellor Rishi Sunak, or the Bank of England (BOE), favor the cable bulls off-late. Also on the positive side could be the US dollar weakness amid broad risk-on mood and the jump in the Western Treasury yields. On the contrary, the extension of deadlock on the Northern Ireland protocol between the UK and European Union (EU) challenges the sentiment.

That said, the US dollar index (DXY) remains depressed for the second day, currently down 0.06% around 89.98.

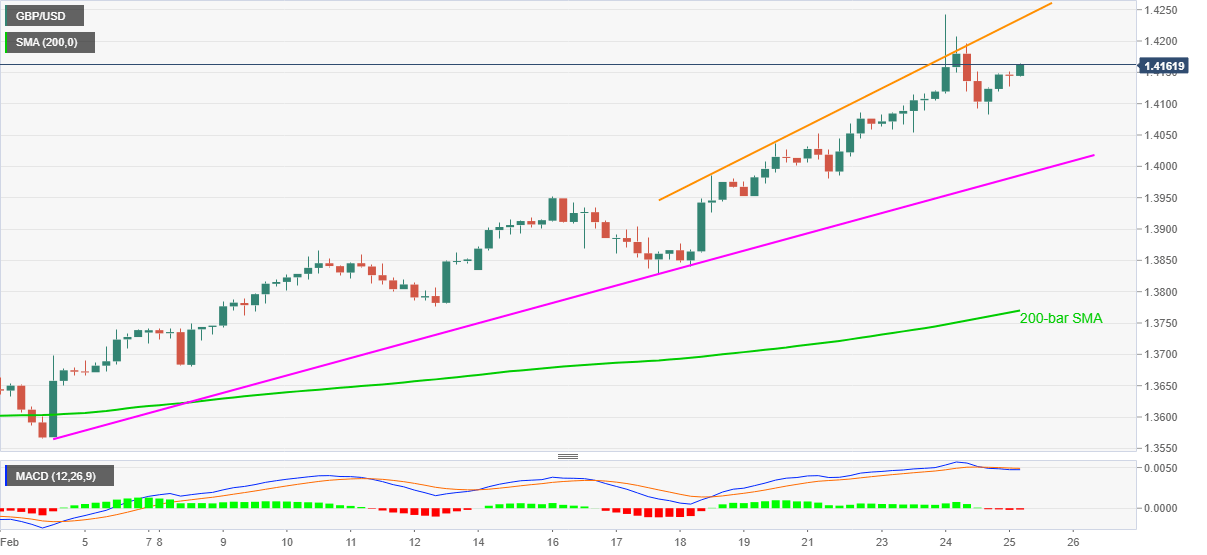

Against this backdrop, the sterling is better shaped to cheer the unlock optimism around the 1.4200 threshold. However, a one-week-old rising trend line could test the pair’s further upside near 1.4235. Additionally, the latest high of 1.4243 and the 1.4300 round-figures are extra filters to the north.

Meanwhile, a three-week-old support line near 1.3985 can test the GBP/USD sellers if they manage to retake controls by breaking the 1.4000 psychological magnet.

However, the bears are less likely to gain the pass until breaking the 200-bar SMA level of 1.3770.

Overall, GBP/USD remains on the front-foot amid multiple positives stated above. However, cautious sentiment before the US Q4 GDP may probe the bulls.

Read: US January Durable Goods and Q4 GDP Preview: Consumers worry but they spend

GBP/USD FOUR-HOUR CHART