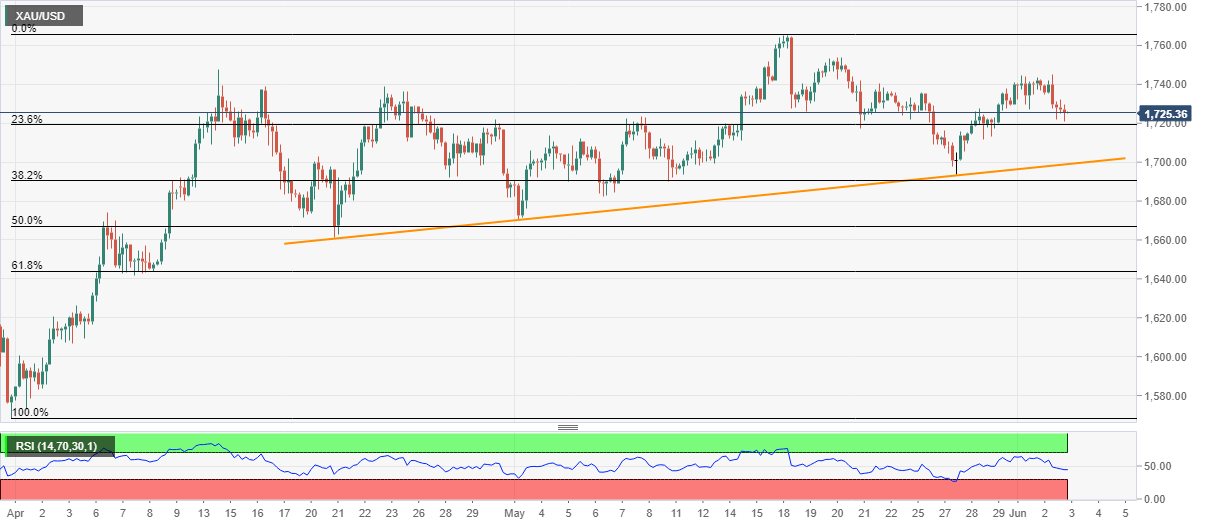

- Gold stays mildly offered after stepping back from $1,745.

- An ascending trend line from April 21 is on the bears’ radars.

- May 20 high holds the key to the further upside toward the previous month’s top.

Gold prices soften to $1,725.40, down 0.13% on a day, while heading into the European session on Wednesday.

Considering the bullion’s moderate pullback since the week’s start, a potential rounding top bearish formation appears on the 4-hour chart.

As a result, the precious metal weighs down towards a six-week-old upward sloping trend line, currently near $1,700. Though, $1,711 might offer an intermediate halt during the fall.

In a case where the metal prices drop below $1,700, the previous month low near $1,670 could lure the bears.

On the upside, a clear break above $1,745 could propel the safe-haven asset towards May 20 high near $1,754 whereas the May month top close to $1,764.90 could keep the buyers engaged afterward.

Gold four-hour chart

Trend: Further weakness expected