- Gold extends Thursday’s losses from two-month top, bounces off intraday low.

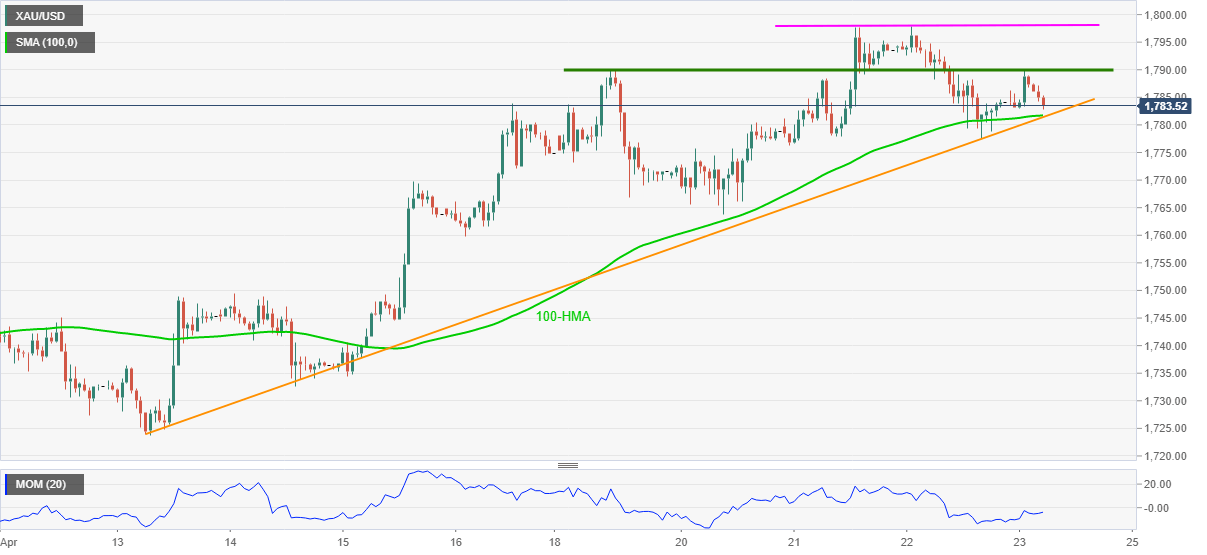

- Downbeat momentum signals further weakness but 100-HMA, eight-day-old support line tests intraday sellers.

- Bulls need a clear break above $1,798 to regain market acceptance.

Gold drops 0.03% despite the latest corrective pullback to $1,784 ahead of Friday’s European session. In doing so, the yellow metal respects the previous day’s U-turn from the highest levels since late February.

Given the Momentum indicator flashing sluggish signs, the commodity prices can stay pressured. However, a convergence of 100-HMA and an ascending support line from April 13 near $1,781 challenges the metal sellers.

Should the quote remain depressed below $1,781, the weekly bottom surrounding $1,763 and last Friday’s low near $1,760 will be in the spotlight.

Meanwhile, the corrective pullback will aim for the $1,790 hurdle comprising multiple levels marked since Monday, a break of which should direct gold buyers toward the key $1,798 resistance comprising recent highs.

It’s worth mentioning that the bullion’s upside past $1,798 needs validation from the $1,700 psychological magnet before eyeing the top late February downswing, near $1,816.

GOLD HOURLY CHART