-

-

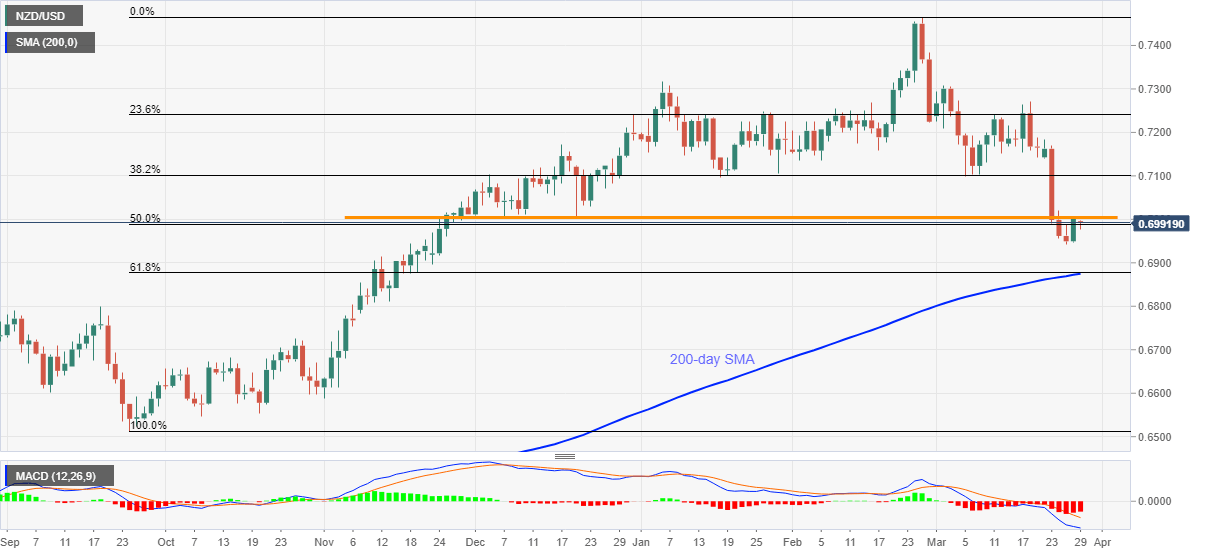

- NZD/USD bounces off intraday low after easing from four-month-old horizontal resistance earlier in Asia.

- Bearish MACD, failures to cross immediate key hurdle favor sellers.

- Confluence of 61.8% Fibonacci retracement, 200-day SMA challenges the bears.

-

NZD/USD trims early Asian session losses while picking up the bids to 0.6990, down 0.24% on a day, during Monday’s initial trading. Even so, the quote stays below a horizontal area from late November 2020 that triggered the latest pullback.

Given the bearish MACD signals and the quote’s failures to cross the key resistance around 0.7005-10, bears are likely to keep the reins until the quote flashes a daily closing above 0.7010.

However, the NZD/USD sellers don’t have much to cheer as the yearly low near 0.6945 holds the key to the quote’s downside targeting 0.6875 support convergence including 200-day SMA and 61.8% Fibonacci retracement level of September-February upside.

Meanwhile, an upside clearance of 0.7010 may not hesitate to challenge the 0.7100 thresold comprising multiple lows marked since January 18 and 38.2% Fibonacci retracement level.

Overall, NZD/USD is witnessing a corrective pullback that needs justification before recalling the buyers.

NZD/USD DAILY CHART