- Silver refreshes intraday low following a pullback from one-week-top.

- Downside break of immediate support line, weakening RSI conditions favor sellers.

- 200-SMA adds to the upside filters before March’s top.

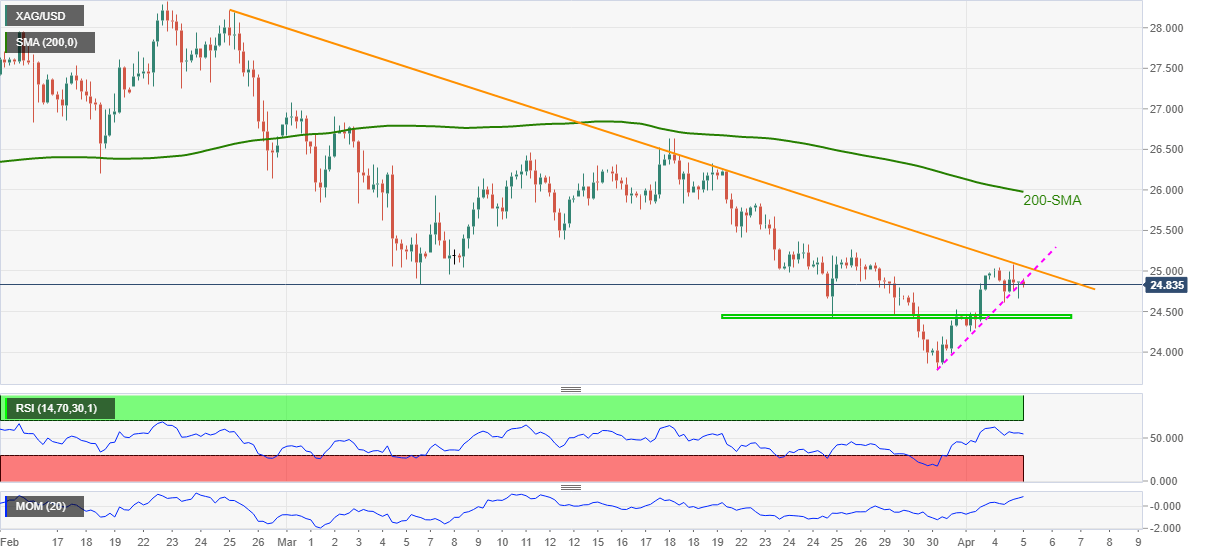

Silver takes offers around $24.81, down 0.31% intraday, during the initial Asian session trading on Tuesday. In doing so, the white metal keeps the recent breakdown of an ascending support line, now resistance, from March 31.

Given the commodity’s ability to break the near-term key support, a horizontal area comprising multiple levels marked since March 25, around $24.40-45 will be important to watch.

Should downward sloping RSI line and a sustained pullback from the key resistance line from February 25 please silver sellers below $24.40, the previous month’s low near $23.80 should return to the charts.

Alternatively, an upside clearance of the nearby resistance line, around $24.90 by the press time, needs validation from a successful break of the $25.00 threshold before directing the bulls toward a 200-SMA level of $25.97.

It’s worth mentioning that the bullion’s ability to cross the $26.00 threshold will be capable of crossing the $27.00 round figure to attack the previous month’s peak near $27.10.

SILVER FOUR-HOUR CHART