- Silver portrays corrective pullback after bearing the heaviest losses in 13 days.

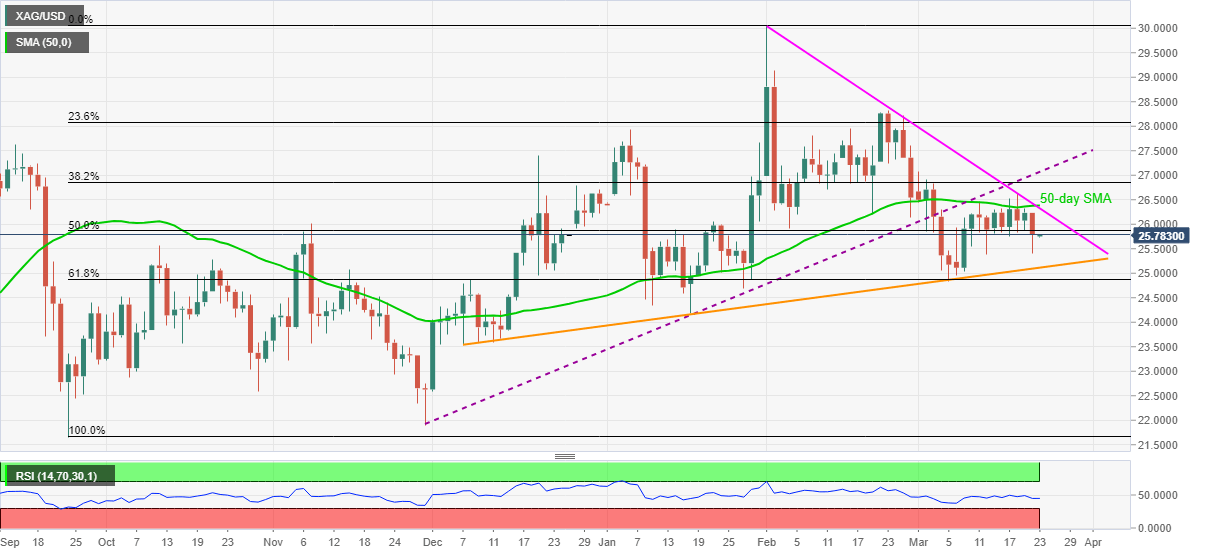

- 50-day SMA, descending trend line from February 01 becomes a tough nut to crack for the bulls.

- Bears eye 14-week-long support line during fresh downside.

Silver refreshes intraday high to $25.77, up 0.15% intraday, during Tuesday’s Asian session. In doing so, the white metal recovers from a one-week low flashed the previous day.

The corrective pullback currently eyes 50% Fibonacci retracement level of the commodity’s rise from September 2020 to February 2021, around $25.90, guards the quote’s immediate upside.

However, a confluence of 50-day SMA and a short-term resistance line guards the quote’s immediate upside around $26.40.

Even if the silver bulls manage to cross the $26.40 hurdle, the previous support line from November 30, at $27.05 now, will test the metal’s additional rise.

Alternatively, an upward sloping trend line from December 07, currently around $25.10, could attack the sell orders before dragging the metal further down to a 61.8% Fibonacci retracement level of $24.88.

In a case where silver bears keep the reins past-$24.88, the yearly bottom surrounding $24.18 could gain the market’s attention.

SILVER DAILY CHART