- S&P 500 futures are seen exposed to upside risks.

- Technical set up favors bulls, with bullish RSI.

- A test of 3,180 likely in the coming sessions.

S&P 500 futures, the risk barometer, has reversed losses in mid-Europe, indicating a positive Wall Street, in light of turn around in the risk sentiment.

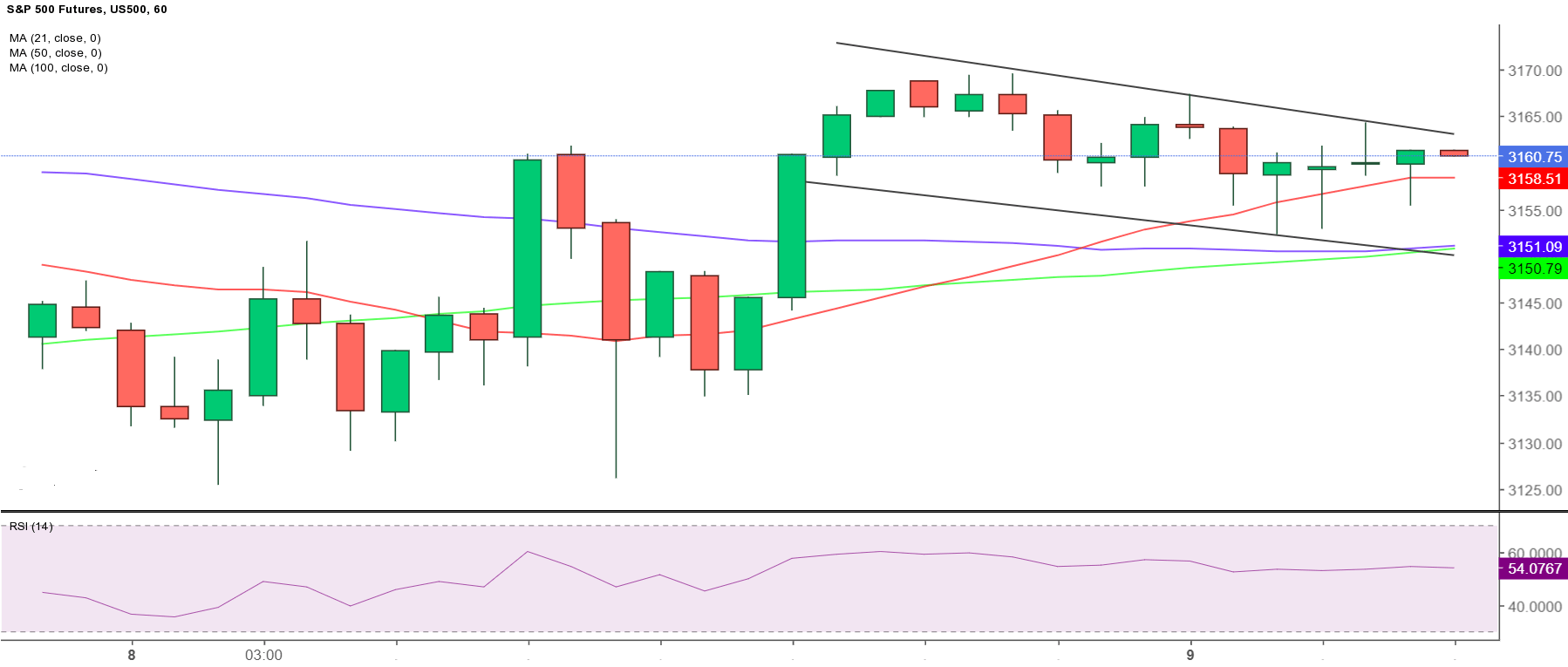

The likely upside bias is also well pictured in the near-term technical set up for the US stock futures, as the price trades within a falling channel.

The pattern will get confirmed on an hourly closing above the falling trendline resistance at 3,163, opening doors for a test of 3,180 – the pattern target.

On the flip side, the immediate downside remains capped by the 21-hourly Simple Moving Average (HMA), now placed at 3,157.

Below that level, powerful support awaits around 3,150.50, where the falling trendline support, 50 and 100-HMAs intersect.

Should the bears manage to clear the aforesaid support, the next support at 3,125 could be put to test.

All in all, the bulls are poised for a break higher, backed by bullish hourly Relative Strength Index (RSI), which holds higher near 55.0. Also, US futures trade above all the major HMAs, supporting the case for an upside bias.

S&P 500 Futures: Hourly chart