- DXY fades recovery moves while printing first run-up in three days.

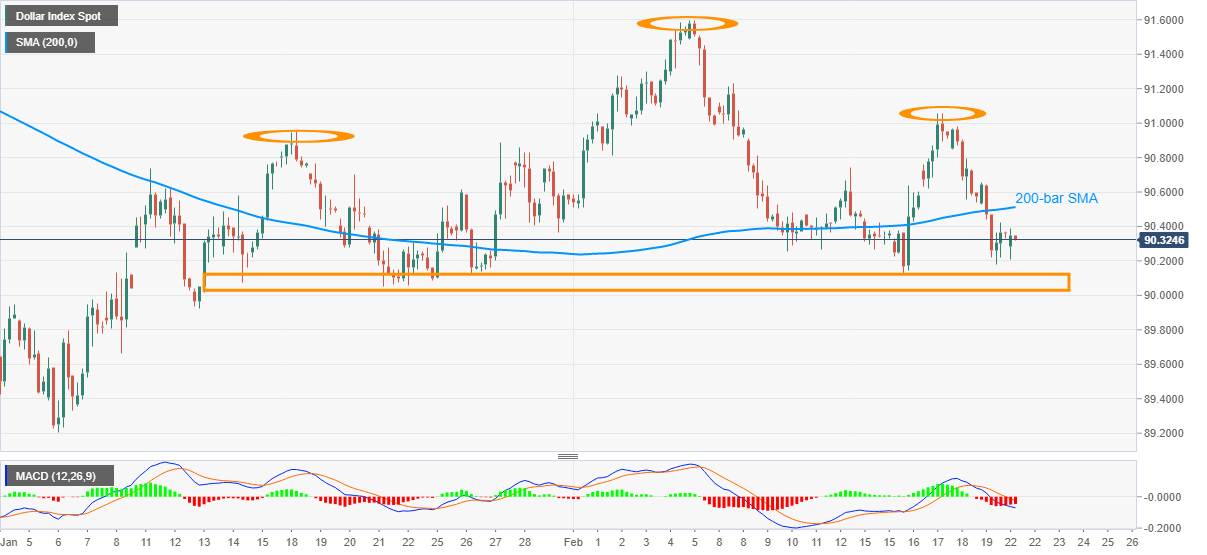

- Bearish MACD, sustained treading below 200-bar SMA, favor formation suggesting further downtrend.

- Last week’s top add to the upside filters beyond SMA hurdle.

US dollar index (DXY) eases from an intraday high of 90.38 to 90.33 while trimming the early-Asian gains, the first in three days, ahead of Monday’s European session.

In doing so, the quote stays inside a bearish chart pattern on the four-hour (4H) formation as the MACD flashes signals for further weakness.

However, sellers will wait for confirmatory moves below 90.10 to retake controls and tease bears with the 150-pip theoretical target. During the fall, the yearly bottom surrounding 89.20 will offer an intermediate halt.

Meanwhile, corrective pullback needs to cross the 200-bar SMA level of 90.51 to target the one-week top near 91.05.

Should the USD buyers stay bullish past-91.05, the monthly peak near 91.60 will return to the chart ahead of directing the moves to confront September 2020 low near 91.75.

DXY FOUR-HOUR CHART