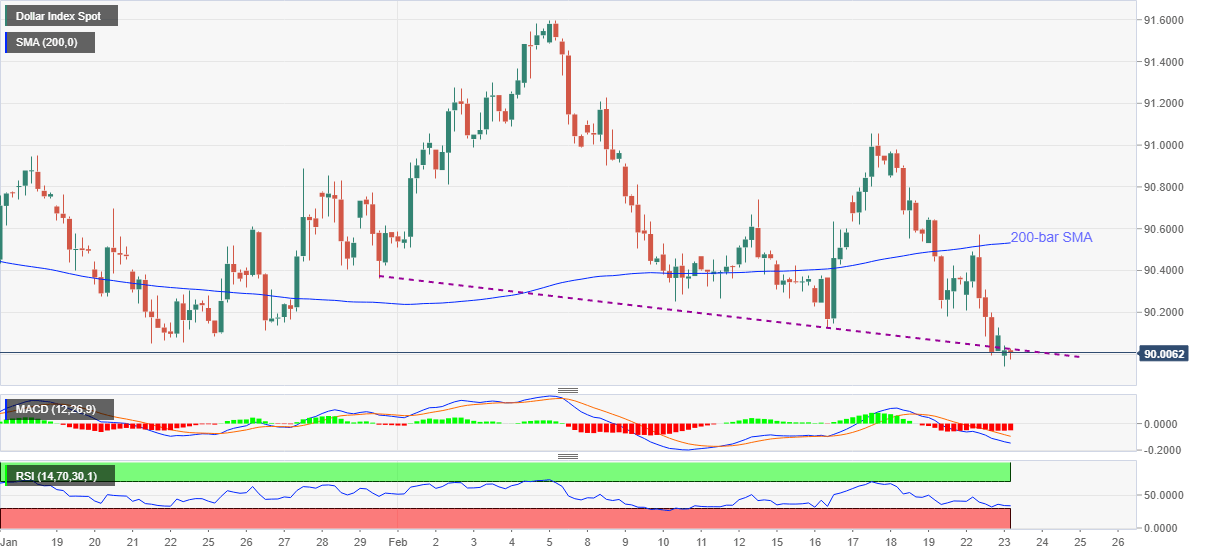

- DXY fails to keep bounce off six-week low.

- Support-turned-resistance from January 29 guards immediate upside.

- 200-bar SMA adds to the resistance, late 2020 lows can offer intermediate halts ahead of the yearly bottom.

US dollar index (DXY) fails to recover, despite the corrective pullback marked during the early Asian session, as the quote drops back to 89.99, down 0.10% intraday ahead of Tuesday’s European session.

While marking the latest weakness from 90.03, DXY respects the strength of the previous support line from January 29. The losses also take clues from the bearish MACD and downbeat RSI conditions.

However, the latest low near 89.94 and the January 13 bottom surrounding 89.92 can restrict immediate declines of the greenback gauge.

Also acting as the short-term supports could be lows marked during December 17 and 31, respectively around 89.72 and 89.51.

In a case where the USD bears refrain to bounce off 89.51, odds of witnessing a fresh low beneath the yearly bottom close to 89.20 can’t be ruled out.

It should be noted that the greenback’s short-term moves may remain sluggish as markets await bi-annual testimony from Fed Chairman Jerome Powell.

Read: Dollar outlook: How will surging treasury yields affect Powell’s testimony

DXY FOUR-HOUR CHART