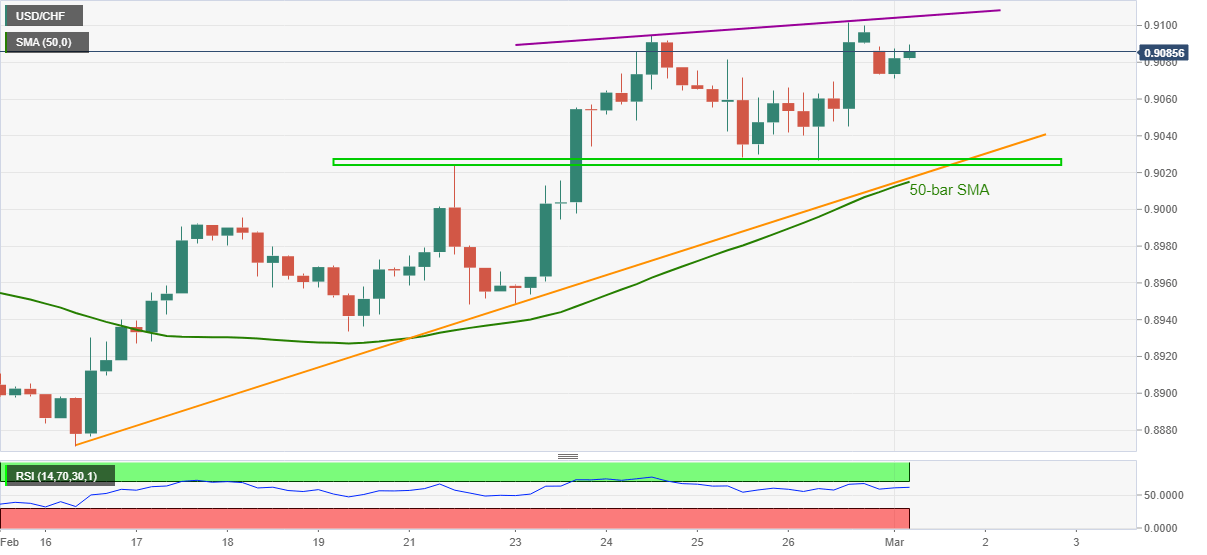

- USD/CHF wavers in a choppy range near intraday top.

- Sustained bounce off one-week-old horizontal support, strong RSI favor bulls.

- Two-day-old rising trend line guards immediate upside, 0.9015-20 offers tough nut to crack for sellers.

USD/CHF takes rounds to 0.9085 while printing mild losses of 0.12% ahead of Monday’s European session. Even so, the quote’s sustained trading above short-term horizontal support, coupled with strong RSI favor bulls.

As a result, an upward sloping trend line from Thursday, at 0.9105 now, lures short-term buyers. Though, the late November 2020 tops around 0.9150 will challenge the USD/CHF buyers afterward.

In a case where the pair rallies past-0.9150, the three-month high close to the 0.9200 will test the USD/CHF bulls.

On the contrary, a downside break of the stated horizontal area around 0.9025-30 will have an upward support line from February 16 and 50-bar SMA, close to 0.9020-15 as another challenge for the USD/CHF sellers to pass.

It should, however, be noted that the pair’s further weakness past-0.9015, will need validation from the 0.9000 psychological magnet before recalling the mid-February lows near 0.8870 back to the chart.

USD/CHF FOUR-HOUR CHART