- USD/CHF stays depressed near intraday low, ignores Friday’s recovery moves.

- Confirmation of a bearish chart joins bearish MACD to keep the sellers hopeful.

- 200-hour EMA adds to the upside filters ahead of the channel resistance.

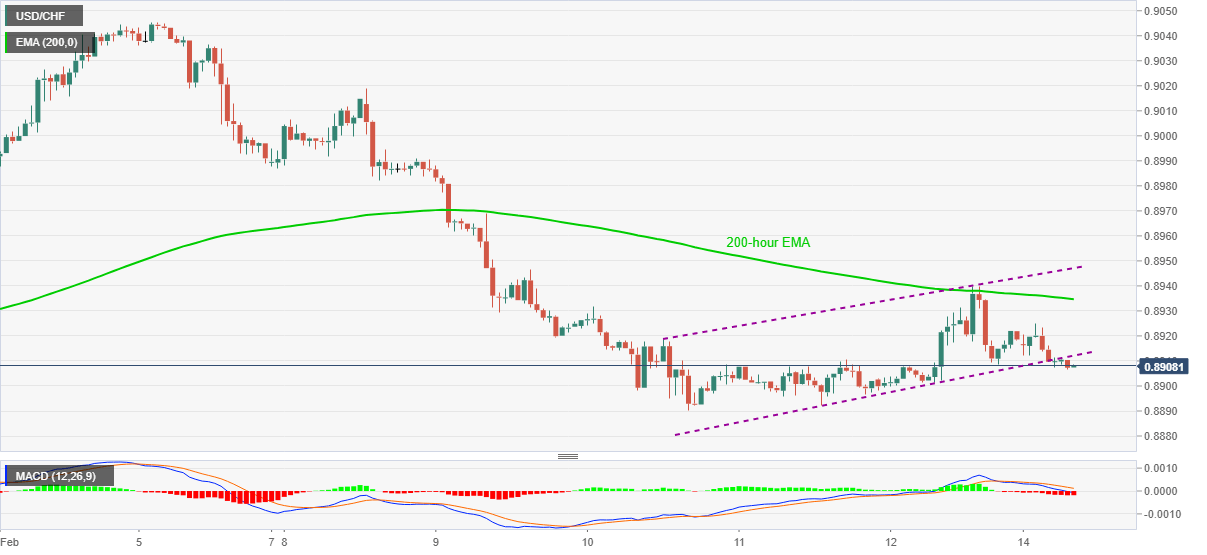

USD/CHF justifies the confirmation of a bearish flag pattern while taking the offers around 0.8907, down 0.13% intraday, ahead of Monday’s European session. In doing so, the pair trades near the recently flashed intraday low wherein bearish MACD adds strength to the downside momentum.

Although the bearish flag confirmation assets 150-pip downside below the breakdown point of 0.8911, the latest low around 0.8890 should validate the immediate declines.

It should be noted that the late January lows near 0.8835 and the previous month’s bottom, also the lowest since January 25, surrounding 0.8760, offer a bumpy road to the south for the USD/CHF sellers.

Alternatively, corrective pullback beyond the previous support line of 0.8911 can eye for the 0.8925 resistance.

However, 200-hour EMA and the upper line of a short-term channel, part of the flag, respectively around 0.8935 and 0.8950, will be tough hurdles for the USD/CHF bulls to cross to regain the confidence.

USD/CHF HOURLY CHART