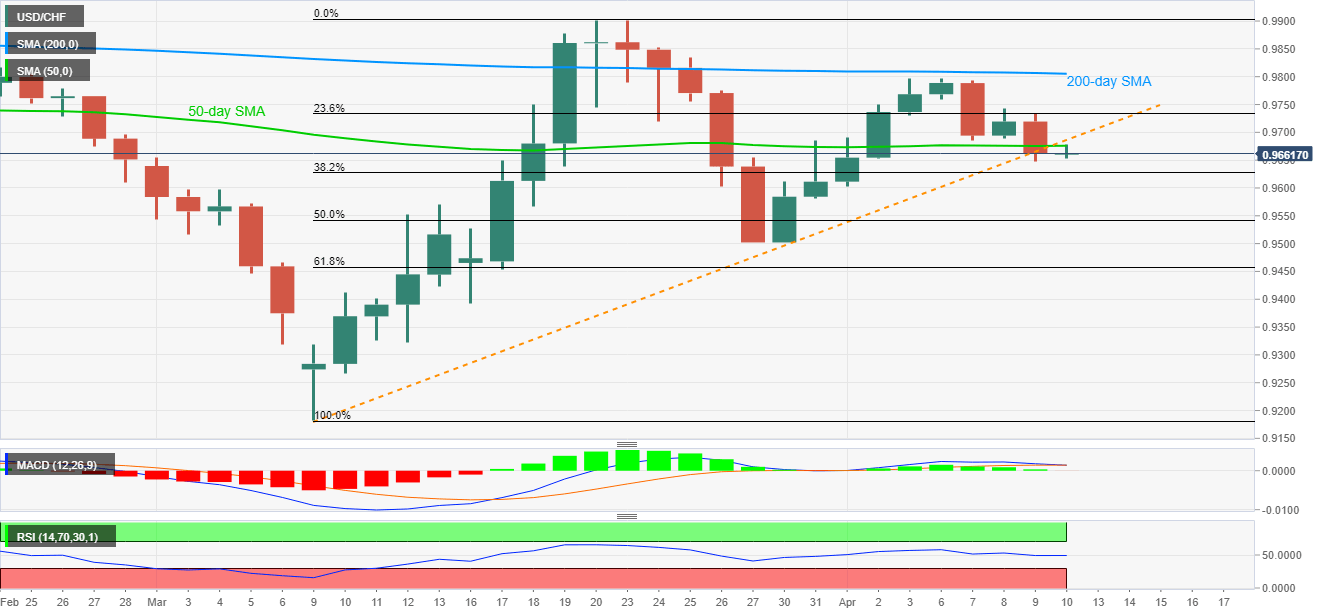

USD/CHF remains on the back foot after breaking near-term key supports, Good Friday holiday restricts the moves.

Late-March lows, 61.8% Fibonacci retracement on sellers’ radars.

200-day SMA adds to the resistance beyond the latest ones.

Although Good Friday’s inactive session restricts USD/CHF moves, the pair remains on the back foot around 0.9660 after breaking near-term key supports the previous day.

Considering the pair’s sustained trading below 50-day SMA and a month-old rising trend line, it is expected to extend the drop towards 38.2% and 50% Fibonacci retracement of its March month upside, respectively near 0.9630 and 0.9540.

It should also be noted that the March 30 low around 0.9500 and 61.8% Fibonacci retracement close to 0.9460 could please the bears below 0.9540.

Meanwhile, the pair’s ability to cross 0.9675/85 support-turned-resistance area could pull it back towards 23.6% Fibonacci retracement figure around 0.9735.

However, buyers are less likely to be called back unless the quote registers a daily closing past-200-day SMA level of 0.9805.

USD/CHF daily chart

Trend: Further downside expected