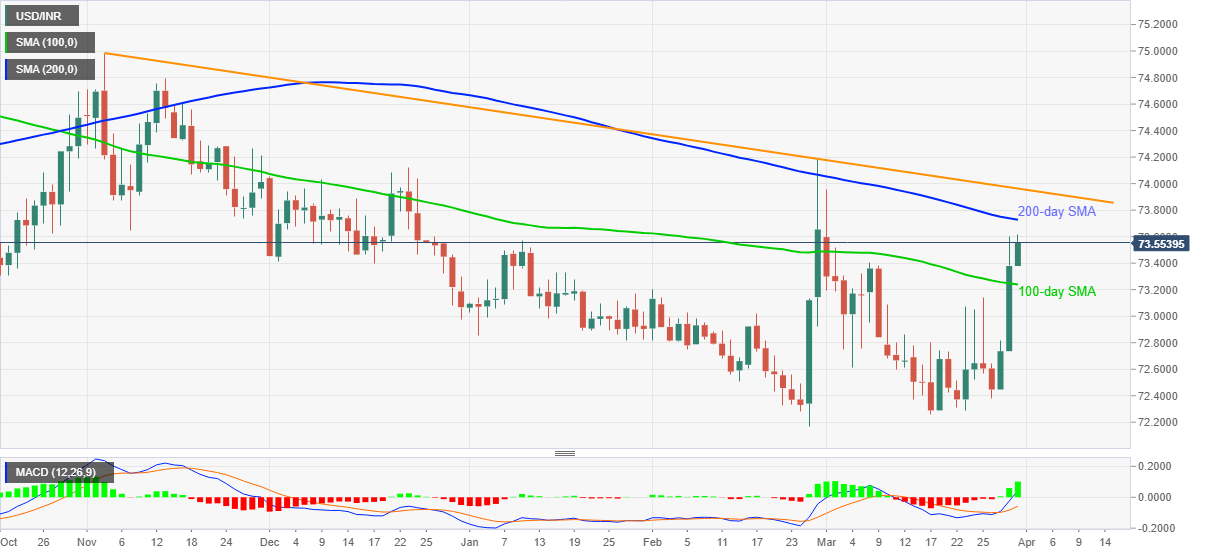

- USD/INR eases from month-start top, keeps upside break of 100-day SMA.

- Bullish MACD signals also favor buyers but 200-day SMA, falling trend line from early November become tough nuts for buyers.

Having refreshed the highest levels since March 01, USD/INR steps back to 73.51, up 0.18% intraday, during the initial Indian session trading on Wednesday.

The pair’s upside break of 100-day SMA for the first time in a month and the most bullish MACD signals since March 02 favor USD/INR buyers.

However, 200-day SMA and a multi-day-old resistance line, respectively around 73.72 and 74.00m challenge the pair’s further rise.

Should the quote rallies past-74.00, February’s high of 74.18 will become USD/INR buyers’ favorite.

Meanwhile, a downside break of the 100-day SMA level, at 73.23 by the press time, will recall the 73.00 threshold on the chart.

Though, any further weakness past-73.00 will have multiple supports between 72.80 and 72.75 to test the USD/INR bears.

USD/INR DAILY CHART