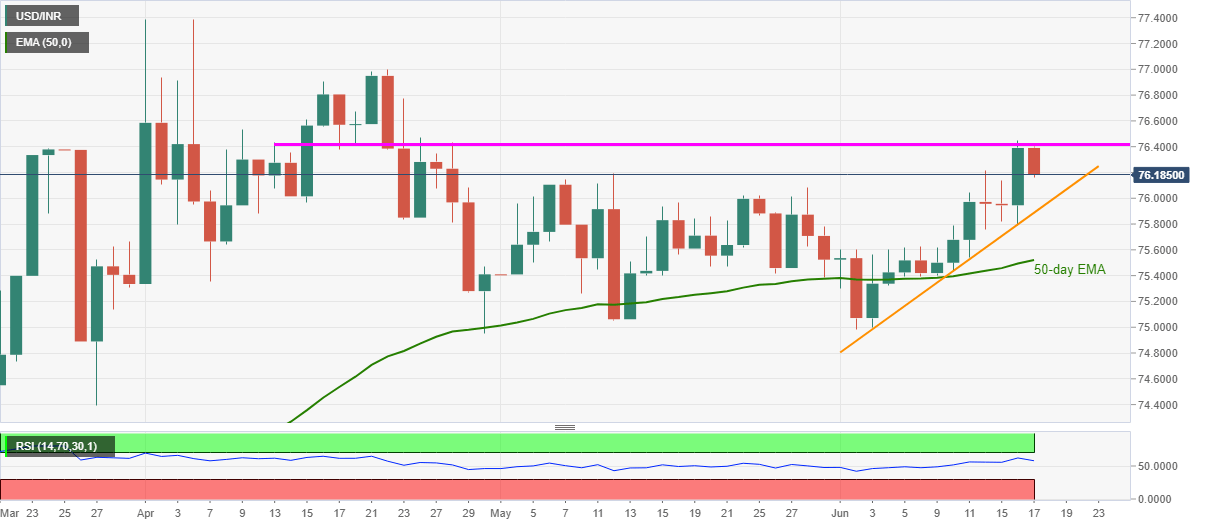

- USD/INR takes U-turn from two-month-old horizontal resistance.

- An ascending trend line from June 03 holds the key to further declines toward 50-day EMA.

- The late-April tops can lure the bulls beyond the immediate upside barrier.

USD/INR drops to 76.19, down 0.27% on a day, during the initial hours of Indian trading on Wednesday. In doing so, the quote reverses from the highest since April 27.

Considering the pair’s repeated failures to cross a two-month-old horizontal resistance around 76.45, the pair can revisit late-May high surrounding 76.08 during the further fall.

However, the pair’s additional weakness past-76.08 might find difficult to sustain as an upward sloping trend line from June 03, at 75.88 now, could question the bears targeting 50-day EMA level of 75.52.

On the flip side, the pair’s ability to cross 76.45 on a daily chart enables it to challenge April 22 peak close to 77.00. Though, the April month highs near 77.40 might probe the bulls afterward.

USD/INR daily chart

Trend: Pullback expected