- USD/INR stays mildly offered near the lowest level in three weeks.

- Tops marked during late December, February tests the pair sellers.

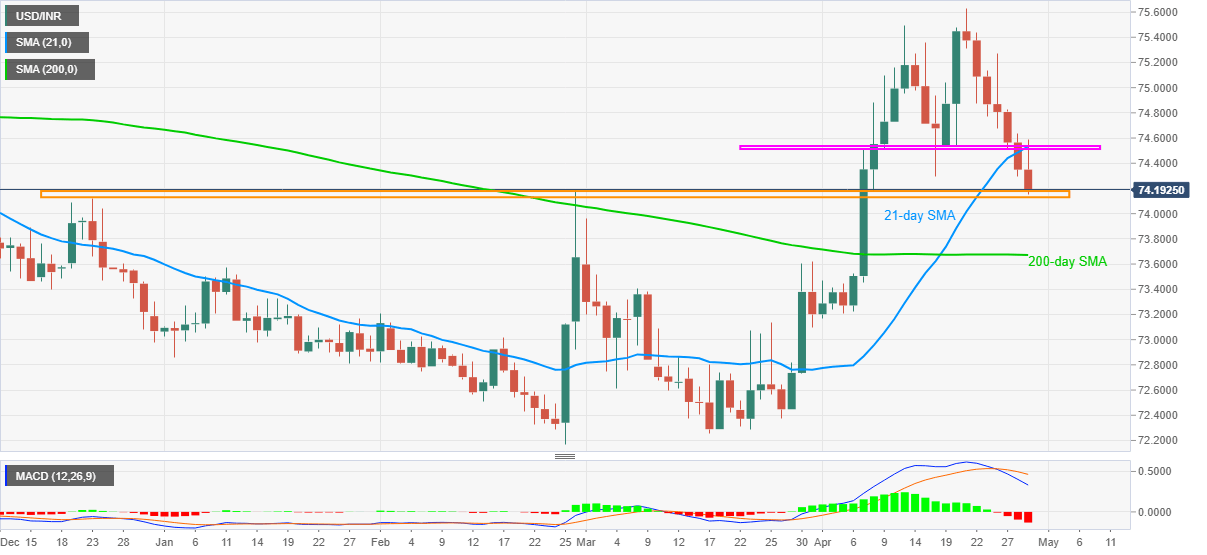

- Bearish MACD, failures to cross 21-day SMA restrict buyer’s entry.

USD/INR fades bounces off intraday low, also the lowest since April 07, while taking offers around 74.20 amid the early Indian trading session on Thursday. In doing so, the Indian rupee pair drops for the seventh consecutive day while marking 0.12% intraday losses by the press time.

Looking at the chart, failure to cross 21-day SMA during the early Asian bounce joins bearish MACD to help the USD/INR sellers attack the key 74.18-12 horizontal support area.

Though, a daily closing below 74.12 will not hesitate to challenge the 200-day SMA level of 73.67. It should, however, be noted that the 74.00 threshold can offer an intermediate halt during the stated decline.

Meanwhile, corrective pullback needs to cross a short-term horizontal area including a 21-day SMA near 74.55 on a daily closing basis to recall the 75.00 round figure.

In a case where USD/INR bulls keep reins beyond 75.00, the 75.30 level may offer an intermediate halt during the rally to refresh the multi-month top of 75.63 marked last week.

To sum up, USD/INR remains on the downward trajectory but bears catch a breather around important support.

USD/INR DAILY CHART