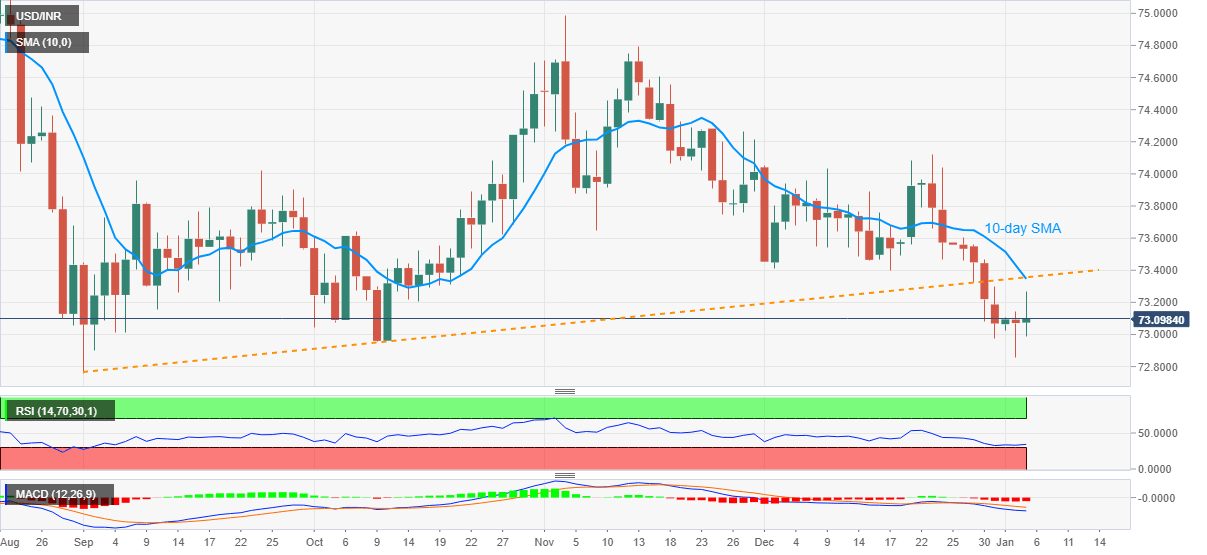

- USD/INR fades recovery moves from four-month low of 72.85, flashed Monday.

- 10-day SMA, previous support line from September 01 guards immediate upside.

- September low lures bears, multiple tops from September 2019 to January 2020 offer strong support.

USD/INR trims the early Asian gains while easing to 73.11 during the pre-European session on Tuesday. The Indian rupee sellers marked a notable comeback from the lowest since September 2020 the previous day. However, the pair bulls lose upside momentum prior to the confluence of 10-day SMA and a four-month-old upward sloping trend line.

With the sustained trading below the key support line, now resistance, coupled with the bearish MACD, USD/INR is likely to remain depressed.

However, lows marked in September 2020, around 72.76, will be the key as it holds the gate for the quote’s further weakness towards revisiting the tops marked during late-2019 and early 2020, around 72.35/20.

On the contrary, an upside break beyond the stated resistance confluence near 73.35 will eye for the early-December bottom near 73.40 ahead of targeting the November month’s trough surrounding 73.65.

During the USD/INR run-up beyond 73.65, a December high near 74.15 will gain the market’s attention.

USD/INR DAILY CHART

Trend: Bearish