- USD/INR stays depressed near multi-day low, drops for third consecutive day.

- One-month-old falling trend line, 21-day EMA guard immediate upside.

- Immediate support line test bears eyeing September 2020 low.

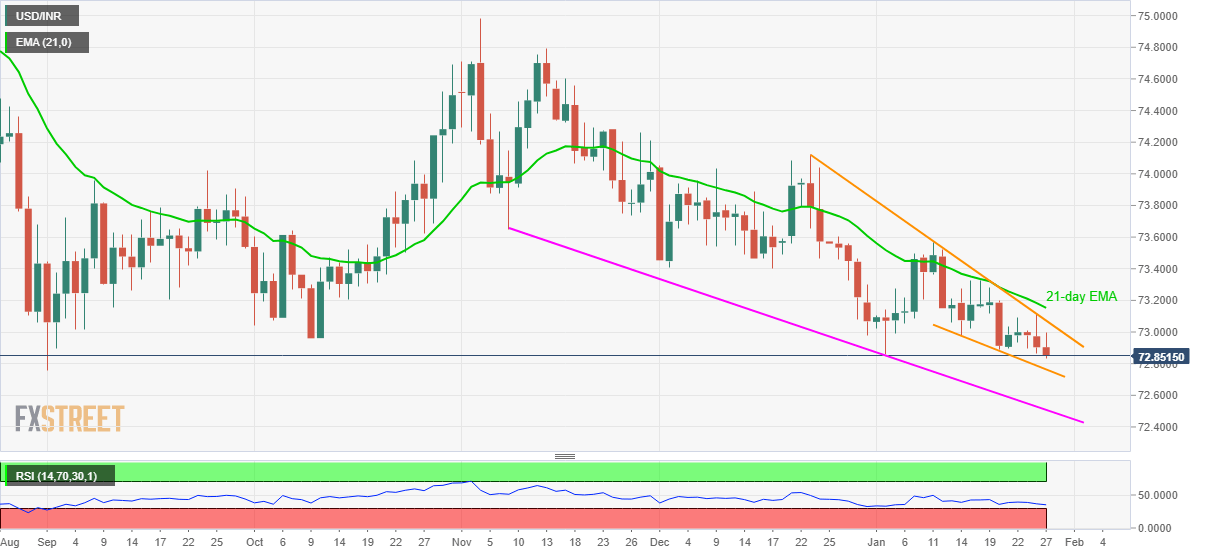

USD/INR drops to 72.85, down 0.05% intraday, ahead of Wednesday’s European session. In doing so, the quote remains heavy near the lowest since September 01 while also marking a three-day losing streak.

With the pair’s repeated failures to cross a descending resistance line from December 23 as well as 21-day EMA, amid an absence of oversold RSI conditions, USD/INR sellers have some room on the downside.

As a result, the latest selling pressure can eye the confluence of September low and a two-week-long falling trend line, currently around 72.76.

However, any further weakness may be tamed by the likely oversold RSI conditions, if not them a downward sloping trend line from November 09, at 72.50 now.

Alternatively, an upside break of the stated resistance line and 21-day EMA, respectively around 73.07 and 73.15, can probe the monthly top of 73.56. Though, the USD/INR bulls may not be convinced unless crossing the 74.00 threshold.

USD/INR DAILY CHART

Trend: Bearish