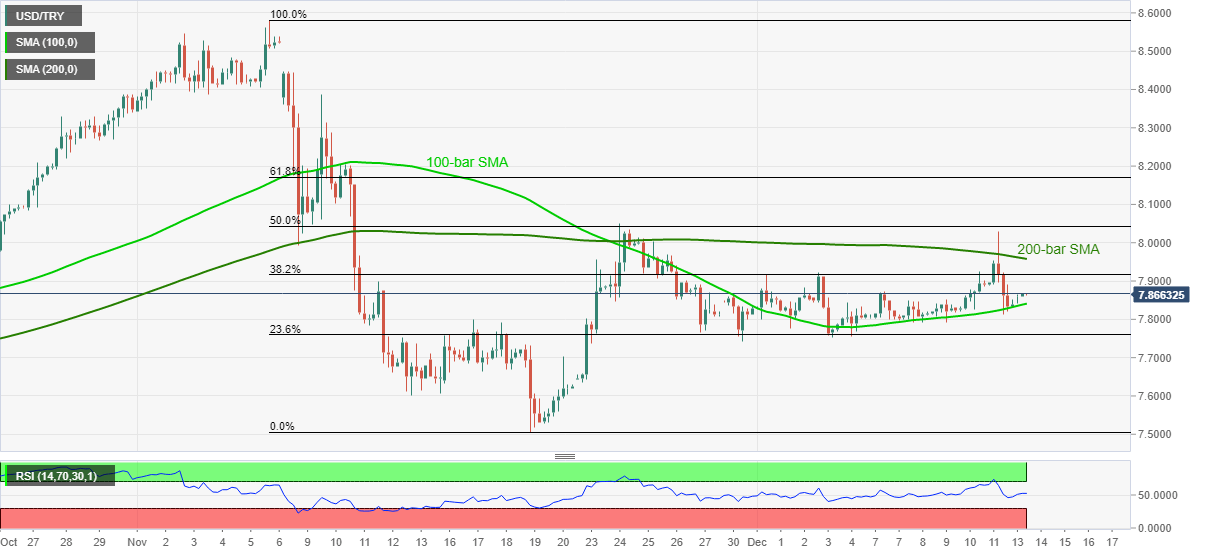

- USD/TRY consolidates Friday’s losses while bouncing off key technical levels.

- 200-bar SMA, 50% Fibonacci retracement challenge the bulls.

USD/TRY prints mild gains, up 0.30% intraday, while taking rounds to 7.8645/50 during the pre-European session on Monday. In doing so, the quote keeps its recovery moves from 23.6% Fibonacci retracement of November’s downside move as well as 100-bar SMA.

With the RSI conditions far from overbought levels, the prevailing retracement from the key supports is expected to eye a 200-bar SMA level of 7.9580 during the further upside.

Though, the pair’s upside past-7.9580 will have to cross the 50% Fibonacci retracement level of 8.0440 to accelerate further.

In a case where USD/TRY sellers return to the desk, 100-bar SMA near 7.8410 and the 23.6% Fibonacci retracement level near 7.7600 will become their short-term targets.

During the pair’s sustained weakness below 7.7600, which is less likely, the mid-November lows near 7.6000 and the previous month’s trough close to 7.5060 will be the key to watch.

USD/TRY FOUR-HOUR CHART

Trend: Further recovery expected