- WTI crude hits the lowest level in two months.

- The bearish momentum looks strong, as per technical studies.

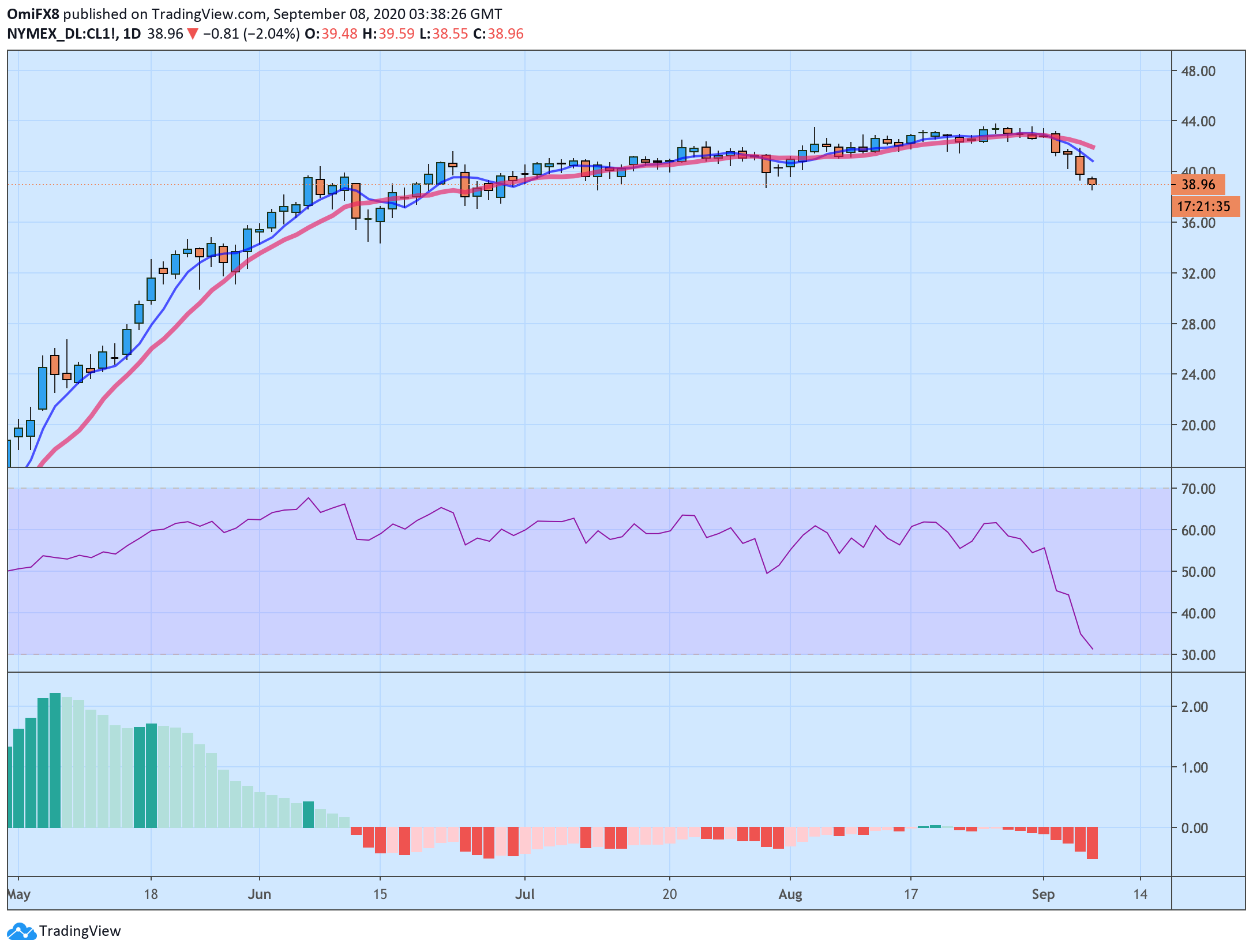

West Texas Intermediate (WTI), a North American crude oil benchmark, fell to $38.55 on Tuesday – the lowest since July 10.

At the current price of $39, the black gold is down 10.4% from $43.57 – the high of the bearish inverted hammer candle created on July 31. That candlestick pattern had warned of an impending sell-off.

More importantly, the price drop could be extended this week, as the daily chart MACD histogram is now printing deeper bars below the zero line. That’s a sign of the strengthening of downward momentum.

The 14-day RSI is signaling bearish conditions with a below-50 print, and the 5- and 10-day simple moving averages are trending south, indicating a bearish setup.

On the downside, key supports are seen at $38.54 (July 10 low) and $37.08 (June 25 low). Alternatively, resistances are located at $40 (psychological level) and $41.97 (10-day SMA). A close above the 10-day SMA is needed to invalidate the bearish bias

DAILY CHART

Trend: Bearish