Empower Your ultimate Financial Future

Challenging established thinking, achieving sustainable advantage

Empower Your ultimate

Financial Future

Challenging established thinking, achieving sustainable advantage

Powered by FX Pricing

Trusted Partner in Achieving Trading Success Globally

At Range Markets, we make trading simple, transparent, and reliable. As a global leader in online trading, we provide direct access to thousands of financial markets, supported by advanced tools and secure platforms.

With a team of experienced traders and a commitment to client success, we serve both retail and institutional traders worldwide. Our goal is to bridge the gaps left by other brokers by delivering fast withdrawals, expert support, and flexible funding options — ensuring you trade with confidence.

Trade the world's most popular markets

Forex

Trade 40+ major, minor, and exotic currency pairs

Indices

Trade 15 of the most famous global indices as CFDs

Stocks

Trade the most covered & highest-profit asset classes

Metals

Trade metals including gold and silver

Cryptos

Trade bitcoins, ethereum, ripple and others

Energies

Trade brent crude oil. WTI, natural gas and coal

Explore Our Account Options

Classic

$ 100 Min Deposit

- Leverage 1:1000

- Max Deposit: $1000

- Spread: 0

- Min Trade Size: 0.01 LOT

- Max Trade Size: 1 LOT

- Market Execution

Premium

$ 100 Min Deposit

- Leverage 1:500

- Max Deposit: $50000

- Spread: 0

- Min Trade Size: 0.01 LOT

- Max Trade Size: 10 LOT

- Market Execution

VIP

$ 100 Min Deposit

- Leverage 1:200

- Max Deposit: $100000

- Spread: 0

- Min Trade Size: 0.01 LOT

- Max Trade Size: 25 LOT

- Market Execution

PRO

$ 100 Min Deposit

- Leverage 1:100

- Max Deposit: Unlimited

- Spread: As Low As 1 Pip

- Min Trade Size: 0.01 LOT

- Max Trade Size: 25 LOT

- Market Execution

ELITE

$ 100 Min Deposit

- Leverage 1:500

- Max Deposit: $25000

- Spread: 4

- Min Trade Size: 0.01 LOT

- Max Trade Size: 100

- Market Execution

Elegant

$ 100 Min Deposit

- Leverage 1:500

- Max Deposit: $25000

- Spread: 3

- Min Trade Size: 0.01 LOT

- Max Trade Size: 100

- Market Execution

EXCLUSIVE

$ 100 Min Deposit

- Leverage 1:500 (Customize)

- Max Deposit: $25000

- Spread: 1

- Min Trade Size: 0.01 LOT

- Max Trade Size: 100

- Market Execution

Classic

$ 100 Min Deposit

- leverage 1:1000

- Max Deposit: $1000

- Spread: 0

- Min Trade Size: 0.01 LOT

- Max Trade Size: 1 LOT

- Market Execution

- Instruments - FX, METALS, OIL & INDICES

- Decimal 5

- Swaps: YES

- Commission - 20

- Platform - MetaTrader 4

- Margin Call - 50%/30%

Premium

$ 100 Min Deposit

- leverage 1:500

- Max Deposit: $50000

- Spread: 0

- Min Trade Size: 0.01 LOT

- Max Trade Size: 10 LOT

- Market Execution

- Instruments - FX, METALS, OIL & INDICES

- Decimal 5

- Swaps: YES

- Commission - 15

- Platform - MetaTrader 4

- Margin Call - 50%/30%

VIP

$ 100 Min Deposit

- leverage 1:200

- Max Deposit: $100000

- Spread: 0

- Min Trade Size: 0.01 LOT

- Max Trade Size: 25 LOT

- Market Execution

- Instruments - FX, METALS, OIL & INDICES

- Decimal 5

- Swaps: YES

- Commission - 10

- Platform - MetaTrader 4

- Margin Call - 50%/30%

PRO

$ 100 Min Deposit

- leverage 1:100

- Max Deposit: Unlimited

- Spread: As Low As 1 Pip

- Min Trade Size: 0.01 LOT

- Max Trade Size: 25 LOT

- Market Execution

- Instruments - FX, METALS, OIL & INDICES

- Decimal 5

- Swaps: YES

- Commission - NIL

- Platform - MetaTrader 4

- Margin Call - 50%/30%

ELITE

$ 100 Min Deposit

- Leverage 1:500

- Max Deposit: 25000

- Spread: 4

- Min Trade Size: 0.01 LOT

- Max Trade Size: 100

- Market Execution

- Instruments - FX METALS

- Decimal 5

- Swaps: YES

- Commission: 0.00

- Platform - MetaTrader 4

- Margin Call - 50%/30%

ELEGANT

$ 100 Min Deposit

- Leverage 1:500

- Max Deposit: 25000

- Spread: 3

- Min Trade Size: 0.01 LOT

- Max Trade Size: 100

- Market Execution

- Instruments - FX METALS

- Decimal 5

- Swaps: YES

- Commission: 0.00

- Platform - MetaTrader 4

- Margin Call - 50%/30%

EXCLUSIVE

$ 100 Min Deposit

- Leverage 1:500 (Customize )

- Max Deposit: 25000

- Spread: 1

- Min Trade Size: 0.01 LOT

- Max Trade Size: 100

- Market Execution

- Instruments - FX METALS

- Decimal 5

- Swaps: YES

- Commission: 0.00

- Platform - MetaTrader 4

- Margin Call - 50%/30%

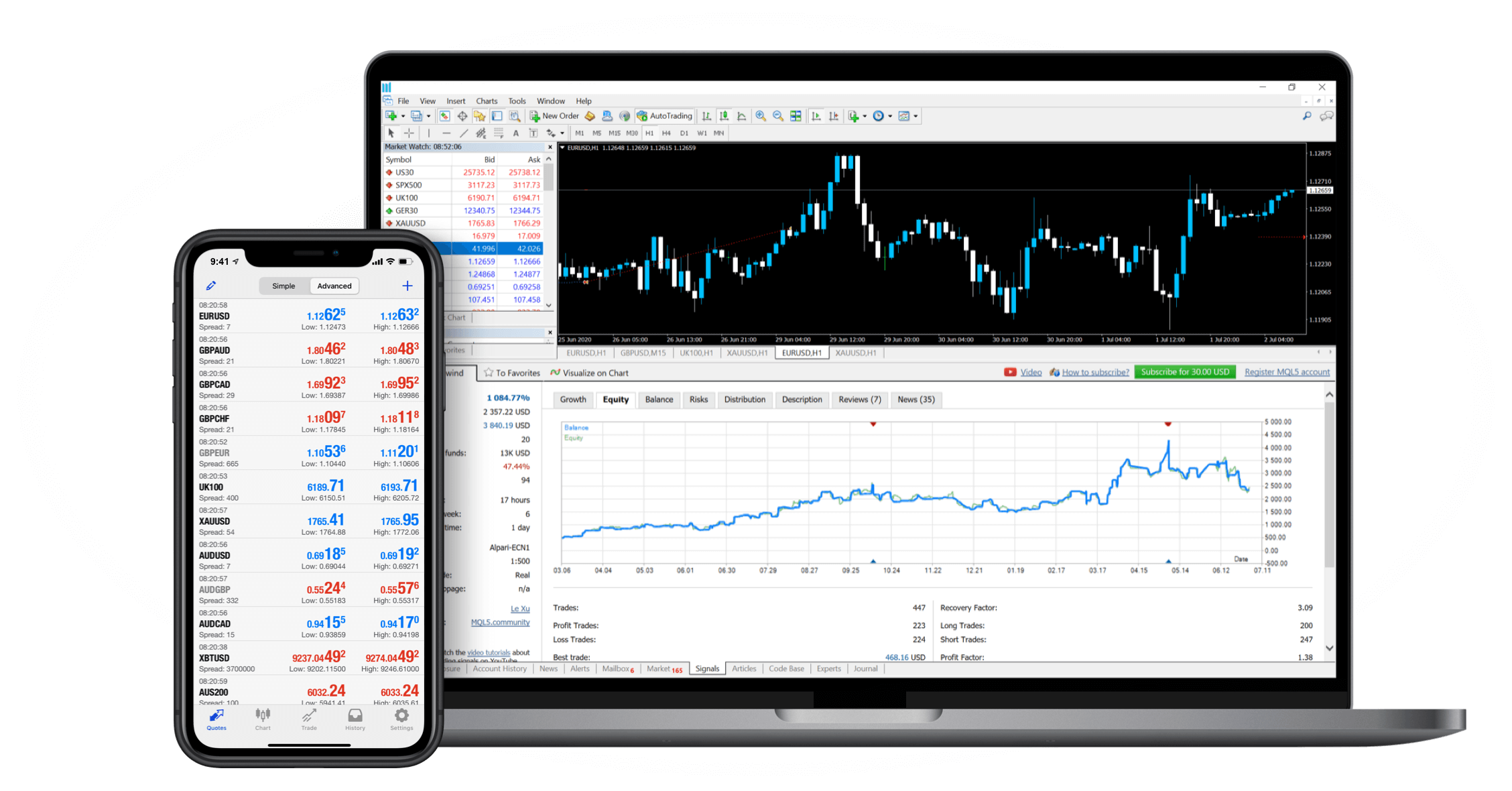

Powerful Trading

Platforms for Every Trader

The MetaTrader4 (MT4) is by far the most popular platform for forex retail traders. More than 95% of the forex brokers offer this platform on their websites. It is one of the most complete trading platforms out there with many features, indicators etc.

Range Markets doesn’t compromise with quality and always try to offer the best and here as well Range Markets offering MetaTrader 4 the best trading platform for its clients.

Range Markets doesn’t compromise with quality and always try to offer the best and here as well Range Markets offering MetaTrader 4 the best trading platform for its clients.

Trusted Trading Broker Facts

Discover the most competitive prices in the market, update regularly for your advantage

Real Experiences, Real Results

Range Markets’ transparent pricing and fast execution bring real value. The support team is always responsive, helping me trade efficiently.

Ahmad RizkiProfessional Trader

The Classic account gave my startup world-class access without the heavy costs. Range Markets truly understands entrepreneurs’ needs.

Suthida CharoenStartup Founder

No dealer intervention, minimal slippage, and superb spreads—I’ve seen noticeable improvements in my trading results. Their platform is seamless.

Nurul HafizahForex Trader

With the Elite account, our team benefits from smart analytics and top-tier liquidity daily. Range Markets has helped us scale up!

Muhammad FarisFund Manager

I’m impressed with the order execution speed and compliance standards. Highly recommend this broker to any serious trader.

Suresh KumarInstitutional Client

Range Markets’ onboarding and support made my entry into forex trading smooth. The demo account was particularly helpful for me starting out.

Maria VictoriaFirst-Time Trader

The VIP account gave my medium-sized team the flexibility and guidance we needed. Range Markets excels at supporting business clients.

Tran Van HungSME Owner

I appreciate that Range Markets offers swap-free account options and maintains full transparency—ideal for traders like me.

Fatima YusufAlgo Trader

As an algorithmic trader, raw spreads and reliable APIs are essential. This platform consistently delivers, allowing my strategies to perform well.

Manish DesaiRetail Trader

The Elegant and Exclusive account tiers provide our growing operation with the resources and access often reserved for larger firms.

Sachin MehtaMargin Trader

Customer care is attentive and personalized. Range Markets supports traders of all backgrounds and helps us succeed.

Rashid Al-HassanBusiness Consultant

All-In-One Trading Solutions

Discover the most competitive prices in the market, update regularly for your advantage