Eurozone Preliminary CPIs overview

Eurostat will publish the first estimate of Eurozone inflation figures for March at 0900 GMT this Tuesday.

The headline CPI is anticipated to come in softer at 0.9% YoY while the core inflation is seen steady at 1.2% YoY during the reported month.

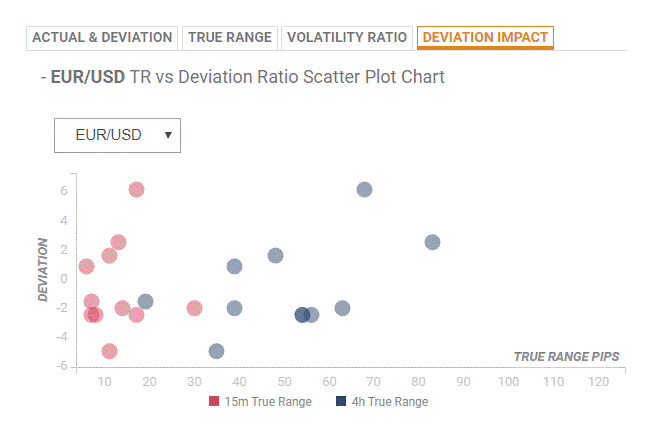

Deviation impact on EUR/USD

Readers can find FX Street’s proprietary deviation impact map of the event below. As observed the reaction is likely to remain confined between 10 and 30 pips in deviations up to 1.5 to -2, although in some cases, if notable enough, a deviation can fuel movements of up to 45-50 pips.

How could affect EUR/USD?

Yohay Elam, FXStreet’s own Senior Analyst, offers important technical levels ahead of the key release: “he currency pair is benefiting from upside momentum on the four-hour chart and trades above the 50 and 200 Simple Moving Averages. Resistance awaits at 1.1090, which was a stepping stone on the way up in recent days. It is followed by 1.1150, the cycle high. Next, 1.1240 and 1.1360 await the pair.”

“Support is at the swing low of 1.0950, followed by 1.0890, which was a temporary resistance line on the way up. Next, 1.0835 held EUR/USD down earlier this month. The next levels to watch are 1.0750 and 1.0640,” Yohay adds.

Key notes

EU Commission expects deeper recession than in 2009 – EurActiv

The week ahead: Data starts to show coronavirus impact

EUR/USD Forecast: Recent corrective bounce might have already run out of the steam

About Eurozone Preliminary CPIs estimate

The Euro Zone CPI released by the Eurostat captures the changes in the price of goods and services. The CPI is a significant way to measure changes in purchasing trends and inflation in the Euro Zone. Generally, a high reading anticipates a hawkish attitude which will be positive (or bullish) for the EUR, while a low reading is seen as negative (or bearish).