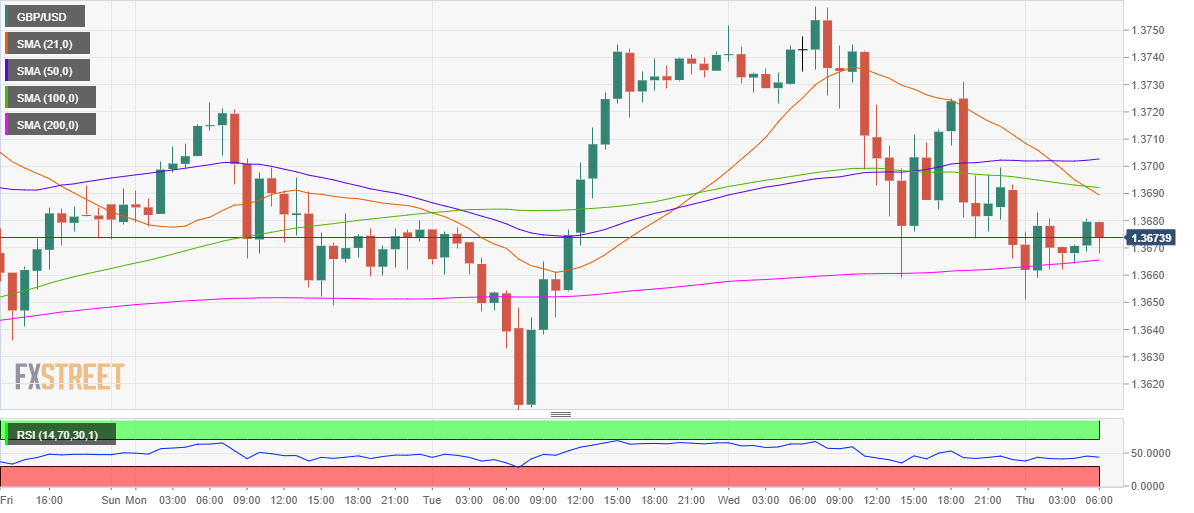

- GBP/USD bulls defending critical 200-HMA support.

- Bearish crossover on the hourly chart risks further falls.

- RSI below 50.00 also backs the downside in near-term.

GBP/USD is consolidating the downside below 1.3700 following the FOMC decision-led decline to near the 1.3650 region.

The Fed maintained the status-quo and noted that the economic recovery hinges on the covid situation and vaccine progress. Meanwhile, Fed Chair Powell refrained from commenting on tapering while markets solid-off risk and bid up the safe-haven US dollar.

The dollar remains on the front foot on Thursday heading into the US Q4 GDP release, pressuring the downside in the cable. Meanwhile, the pound suffers from the UK-EU tussle on the covid vaccines from AstraZeneca.

The technical outlook for the spot remains bearish in the near-term, with a retest of the 1.3650 level likely on a breach of the critical 200-hourly moving average (HMA) at 1.3665.

The bears remain in control as the 21-HMA has cut the 100-HMA from above, representing a bearish crossover on the hourly sticks.

The Relative Strength Index (RSI) also looks south below the midline, allowing room for more declines.

A failure to defend the daily lows at 1.3651 could expose the 21-daily moving average (DMA) at 1.3640, which is the last straw for the GBP bulls. The price hasn’t closed below that level since January 11.

Alternatively, any pullbacks could be short-lived near 1.3690, the confluence of the 21 and 100-HMAs. The next upside target for the buyers is seen at the 50-HMA at 1.3702.

GBP/USD: HOURLY CHART