These are the main highlights of the CFTC Positioning Report for the week ended on February 2nd:

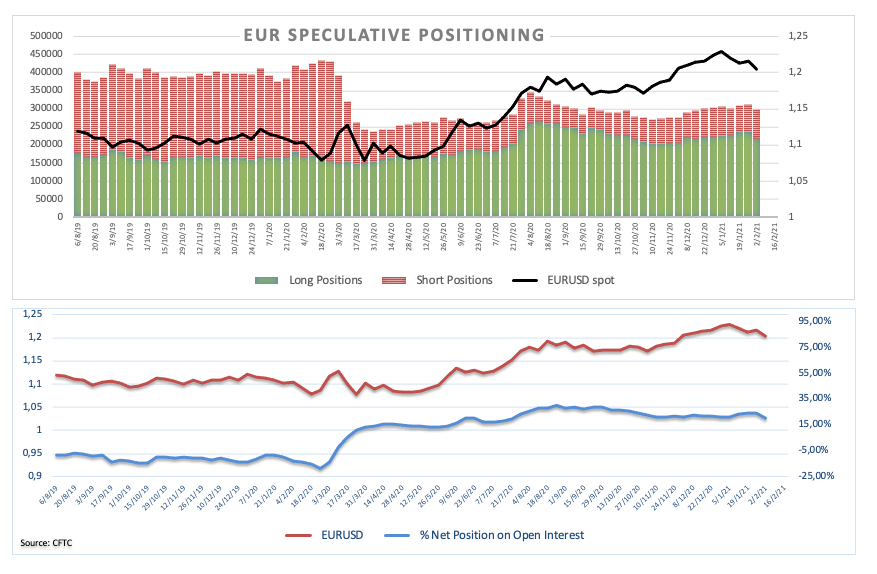

- Net longs in EUR receded to levels last seen in mid-November 2020. The rally in the greenback coupled with some disappointing results in the euro docket and the likeliness of a double-dip recession in Euroland weighed on the single currency.

- Speculators remained negative on the USD despite the rebound in US yields and auspicious results in key fundamentals. In addition, the vaccine rollout in the US keeps outperforming its peers and is expected to keep lending support to the buck in coming days.

- Gross longs in the British pound rose for the second consecutive week and pushed net longs to 2-week highs. The faster-than-expected vaccine rollout in the UK and the upbeat assessment of the Bank of England at its event also lent oxygen to the quid.

- JPY net longs retreated to levels last seen in mid-December 2020. The rebound in US yields and the better tone in the riskier assets in combination with the downtrend in the volatility index favoured JPY-sellers.