- EUR/GBP probes intraday top while defying the previous day’s downbeat momentum.

- MACD losses bullish bias, 100-bar SMA adds to the upside filters.

- Sellers will wait for a clear break of previous resistance line for entry.

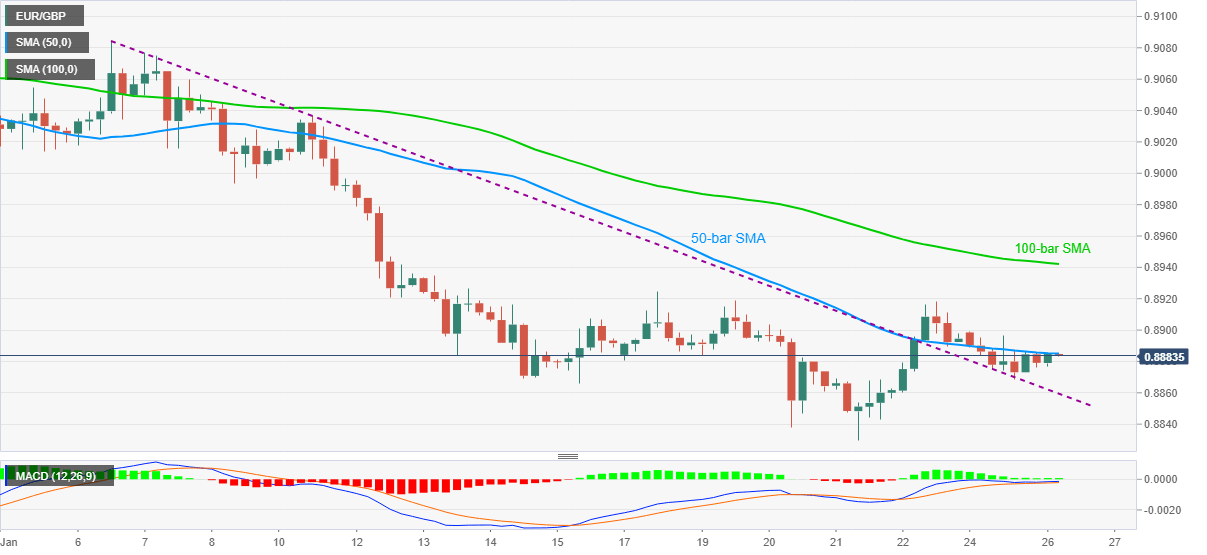

EUR/GBP flirts with the intraday high of 0.8885 during early Tuesday. In doing so, the pair battles 50-bar SMA on the four-hour (4H) chart amid receding bullish signals from the MACD.

However, sellers are less likely to enter unless witnessing a clear downside break of a descending trend line from January 06, at 0.8860 now, not to forget waiting for the UK’s latest employment data.

Read: UK Jobs Preview: Another positive surprise? GBP/USD could use a shot in the arm

In a case where the quote successfully crosses the immediate 0.8885 hurdle, Friday top near 0.8920 and 100-bar SMA around 0.8945 will challenge the EUR/GBP buyers.

It should, however, be noted that the pair’s ability to cross 0.8945 enables it to revisit the early-month low near 0.8990 and the 0.9000 psychological magnet.

Alternatively, a downside break below 0.8860 will eye for the monthly low of 0.8830 and the 0.8800 round-figure during the further weakness.

Overall, EUR/GBP remains in a downtrend ahead of the key UK employment report.

EUR/GBP FOUR-HOUR CHART

Trend: Bearish