- EUR/GBP snaps three-day uptrend while attacking intraday low.

- UK CPI expected to regain traction, expected to rise 0.5% YoY in December.

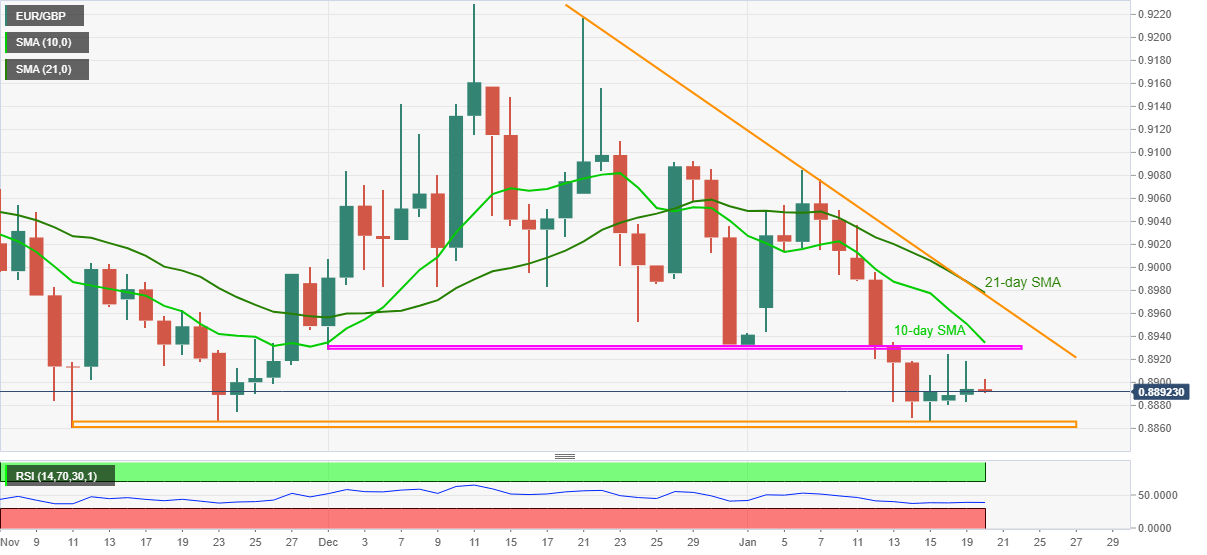

- Seven-week-old horizontal area, 10-day SMA guard immediate upside, bears need to break November low for confirmation.

EUR/GBP remains depressed intraday low of 0.8891 while heading into London open on Wednesday. In doing so, the pair drops for the first time in four days.

The move should be considered an early sign of the UK CPI data, up for publishing at 07:00 GMT. However, the virus woes and the Brexit worries offer further hardships to the sterling, which in turn suggests EUR/GBP strength.

Read: When are the UK CPIs and how could they affect GBP/USD?

Even so, a horizontal area including lows marked since December 01, around 0.8930, precedes 10-day SMA level of 0.8934 to challenge the quote’s immediate upside.

In a case where the EUR/GBP buyers manage to cross 0.8935 hurdle, a confluence of 21-day SMA and a falling trend line from December 21, near 0.8978/80, will be a tough nut to crack for the bulls.

On the flip side, the current bearish impulse may target the region comprising multiple lows marked since November 11 between 0.8860 and 0.8865.

Overall, EUR/GBP bears technically have an upper hand but the fundamental challenges for the UK could trigger intermediate consolidation.

EUR/GBP DAILY CHART

Trend: Bearish