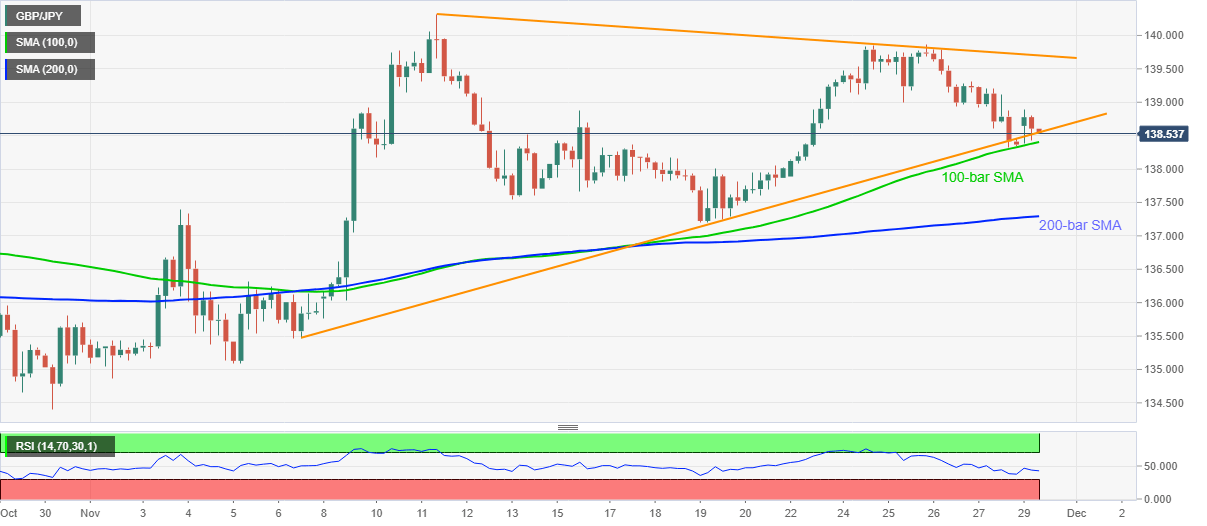

- GBP/JPY trims early-day gains while staying near short-term key supports.

- Normal RSI conditions suggest pullback, descending trend line from November 11 becomes the key.

GBP/JPY fails to keep the week-start gap-up while easing to 138.55, up 0.14% intraday, during the pre-London open trading on Monday. Even so, 100-bar SMA and an ascending trend line from November 06 restricts the pair’s short-term downside.

With the RSI line far from extreme conditions, the latest pullback from the crucial supports is likely to push the GBP/JPY buyers towards the November 25 low of 139.00.

However, any more recovery moves will need a clear break above the 13-day-old falling trend line, at 139.70, to battle the 140.00 threshold and the monthly top close to 140.30.

Meanwhile, a downside break of the 138.55/40 support zone, comprising the crucial SMA and stated rising trend line, will lead the pair sellers toward the 200-bar SMA level of 137.30.

It should be noted that November 19 lows near 137.20 will be important to watch for the GBP/JPY bears to watch after 137.30.

GBP/JPY FOUR-HOUR CHART

Trend: Further upside expected