- Silver trims early Asian losses while bouncing off $25.24.

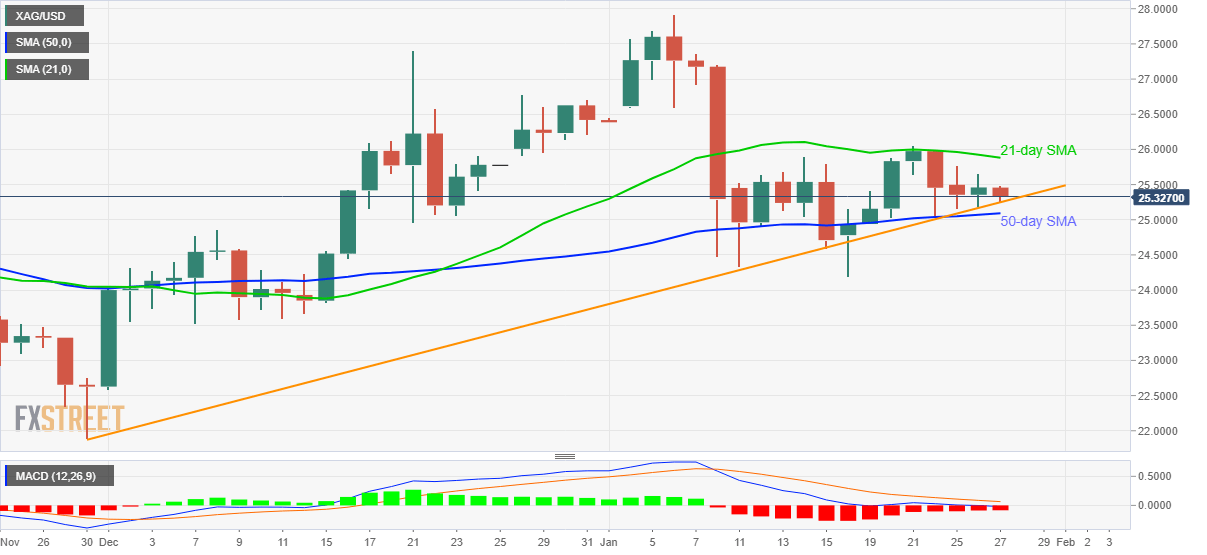

- Two-month-old rising trend line, 50-day SMA restricts immediate downside.

- 21-day SMA joins bearish MACD to guard upside momentum.

Silver prices pick up bids around $25.35, down 0.50% intraday, while trying to recover during early Wednesday. In doing so, the white metal bounces off an ascending trend line from November 30. However, bearish MACD and 21-day SMA can challenge the corrective pullback.

Hence, the present bounce can refresh the weekly top, above the current $25.77, but 21-day SMA near $25.88, followed by the $26.00 will stop probe the silver bulls afterward.

Alternatively, a downside break of the stated support line, at $25.25 now, will have to break below the 50-day SMA level of $25.09 and the $25.00 round-figure to convince sellers.

While an upside break of $26.00 can eye the monthly top of $27.92, with $26.60-65 acting as an intermediate halt, the commodity’s declines below $25.00 will not hesitate to refresh the monthly bottom of $24.18.

To sum up, silver prices are flashing mixed signals, despite gradually recovering, ahead of the key Federal Reserve meeting.

Read: Fed Preview: Fearing market froth or boosting Biden’s stimulus? Three scenarios

SILVER DAILY CHART

Trend: Sideways