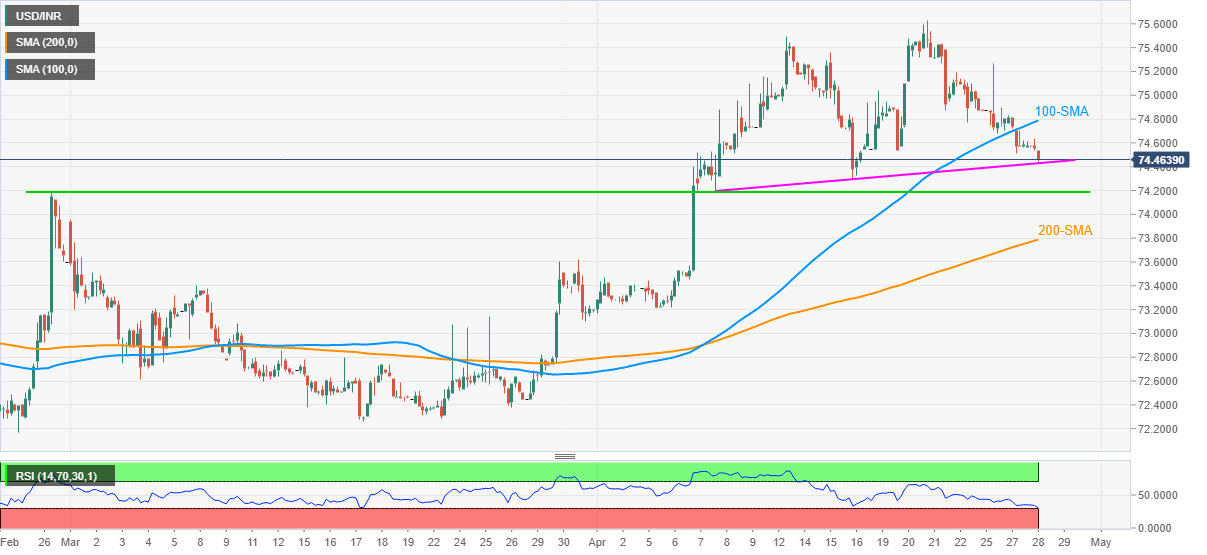

- USD/INR stays pressured near the lowest in eight days.

- Oversold RSI suggests corrective pullback towards 100-SMA.

- Two-month-old horizontal support, 200-SMA can lure the bears during further downside.

USD/INR remains depressed around 74.46, down 0.13% intraday, as sellers jostle with short-term key support during the early Indian trading session on Wednesday.

Although the quote’s sustained trading below 100-SMA keeps favor USD/INR bears, oversold RSI signals a bounce off 74.40 immediate trend line support.

Should corrective pullback extends beyond the 100-SMA level of 74.80, the 75.00 threshold and 75.30 may entertain USD/INR buyers ahead of directing them to the multi-day top of 75.53.

Alternatively, a downside break of 74.40 isn’t an open invitation to USD/INR bears as the late February top near 74.20 and the 74.00 round-figure will test any further downside.

In a case where the pairs fail to recover from the 74.00, the 200-SMA level of 73.78 will gain the market’s attention.

USD/INR FOUR-HOUR CHART